News

News

AP+ 2025 Roadmap

30 January 2025

Following the release of our inaugural product roadmap in 2024, we are pleased to publish our updated 2025 roadmap that combines our product and infrastructure priorities. The 2025 AP+ Roadmap outlines key industry and regulatory requirements alongside other major initiatives.

Key updates include:

- Click to Pay for eftpos

- Consolidated developer portal and consolidated member portal

- NPP multi-credit transfer solution design

- NPP process and message usage uplift

Along with the above changes we are confirming December 2026 as the delivery date to upgrade the ISO 20022 version that the NPP operates on.

Exploratory work also continues, and any successful developments will be included in future roadmap updates.

We will continue to engage with the industry and our members as we progress, and updated versions of the AP+ roadmap will be published annually.

The 2025 AP+ Roadmap outlines key industry and regulatory requirements alongside other major initiatives.

Move to NPP: to prepare for the decommissioning of BECS in 2030, we are focusing on ensuring the NPP has the capability, capacity, reach and resilience to easily manage the expected volume of direct entry payments. This work includes:

- NPP process & message usage uplift: developing an approach for the return of bulk payments processed through the NPP; introducing batch identifiers to support the grouping of transactions; introducing a standard payment instruction format that end users can provide to their financial institution; and uplifting PayTo message usage (Merchant Category Codes, Ultimate Creditor) to support improved fraud screening.

- NPP ISO version upgrade: upgrading the ISO20022 version that the NPP operates on to enable software integrations by international vendors and benefit from innovations adopted in other markets.

- NPP Multi Credit Transfer solution: AP+ will begin detailed design work with industry in 2025 to support high-volume bulk payments with multiple transactions contained within a single message.

- NPP cloud migration: this will allow directly connected participating organisations to integrate their back office with the NPP platform infrastructure via public cloud providers.

- NPP capacity upgrades: ensuring that processing capacity is uplifted across the platform and participating organisations.

Mobile Least Cost Routing (LCR) implementation: the industry is expected to support mobile LCR by the end of 2024.

QR acceptance: our goal is to enable initiation for in-store payments using any smart device, initially via QR. It aims to provide consumers with a greater variety of services at the point of sale and integrate other experiences such as loyalty programs or simplified integrated initiation.

eftpos – token cryptogram: introducing a token cryptogram for cardholder-initiated transactions to enhance the security and efficiency of the Australian payment ecosystem, while fostering customer trust, and compliance with evolving industry standards.

Confirmation of Payee (CoP): a layer of protection for payments to a BSB and account number in Australia. By matching the account name, BSB and account number entered with the details held by the recipient’s bank, Confirmation of Payee gives more confidence that payments are going to the right account.

eftpos – Click to Pay implementation: AP+ is standing up a Click to Pay service with the ambition to streamline e-commerce checkout and make it consistent, convenient and secure.

NPP PayTo porting: allow consumers to move PayTo agreements between financial institutions without having to contact each merchant and re-authorise their PayTo agreements. This will reduce the impact on merchants when their customers change banks.

Osko / SCT harmonisation: brings together the BPAY OSKO service with the native Single Credit Transfer (SCT) NPP product to simplify real-time payments into a single service, with a single brand and clear value proposition, streamlined rules and associated operational processes.

eftpos to update to 3DS 2.3: AP+ plans to support 3DS 2.3 to help reduce cart abandonment rates and provide enhanced risk management.

3DES migration to AES: Australian card payments will be migrated from 3DES to a new encryption standard (AES) by 2030.

Portal consolidation: AP+ is consolidating the developer experience across our products into a singe developer portal. We are also creating a single front door for members with a unified and streamlined member portal.

Cyber security capability uplift, fraud capability uplift and trust layer: AP+ is uplifting its maturity in the foundational cyber capabilities required to govern, identify, protect, detect, respond and recover from cyber incidents. AP+ is also expanding fraud capability across each AP+ scheme and supporting industry fraud and scam initiatives.

Australian Consumer Spending Holds onto Gains, Starts 2025 in Expansion Territory

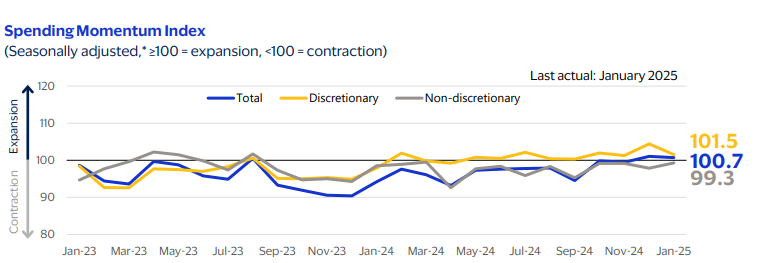

After a weak year overall for Australian consumer spending, Visa’s Australia Spending Momentum Index (SMI) remained in expansion territory at 100.7 in January. The reading’s relative consistency with the previous month, which included strong holiday sales, bodes well for a sustained recovery. Spending momentum improved in all states and territories except for the Australian Capital Territory. While Victoria and Queensland were the only two states with readings below 100, their first readings for 2025 were above their 2024 averages and are on track to hit the 100 mark. Following the holiday shopping season, the discretionary SMI fell 2.9 points to a still-solid 101.5 in January. The index stayed above 100 for the ninth consecutive month, indicating strength in spending momentum on non-essentials, such as travel. The index for all states and territories remained at healthy levels, with Queensland having the strongest reading. At the same time, restaurant spending momentum saw a decline, led by the Northern Territory and South Australia. By contrast, the non-discretionary index inched up 1.4 points to 99.3, with the strongest improvement in two states that experienced weak consumer spending in 2024: Tasmania and South Australia. With inflation slowing, consumer spending is expected to be resilient, with geopolitics and the pace of interest rate cuts two major risk factors to watch.

Spending Momentum Index (Seasonally adjusted,* ≥100 = expansion, <100 = contraction), last actual: January 2025

Download the Complete Report

*The discretionary and non-discretionary categories exclude restaurant and gas spending; both restaurant and gas are included in the total SMI. See additional definitions of spending categories on page 3 of the attached report.

Source: Visa Business and Economic Insights. The Visa Australia SMI measures the current month relative to the same month last year. The national readings of the index are based on year-over-year changes in consumer spending with Visa bankcards.

Protecting your digital identity

During this Scams Awareness Week, we’re sharing our top tips to combat scams. Following on from Safeguarding older and vulnerable individuals from scams today we bring you the next tip in our series.

Tip 2: Protect your data like you protect your wallet!

Financial institutions spare no effort in combating fraud and protecting their customers from scammers, and there are thousands of people working around the clock to protect you and your money.

However, in recent years scammers have realised they are competing with advanced multimillion-dollar fraud detection controls and systems, and therefore the path of least resistance is to trick customers into helping them bypass the fraud controls that are put in place for customer protection.

The truths we must acknowledge:

1. Scammers already have some of your data

There’s an alarming amount of compromised data out there, and scammers are becoming increasingly skilled at exploiting it. The numerous Australian data breaches publicised widely are just the tip of the iceberg.

You can check how many data breaches have involved your details at this website: https://haveibeenpwned.com/

2. If you think you are too smart to be scammed, you are a great target!

Scammers, armed with your stolen data, can piece together a comprehensive profile of their targets. That seemingly innocent chat on WhatsApp or a transaction on Facebook Marketplace can be a data-mining expedition. This, in turn, can be exploited to build trust and manipulate people into compliance.

The following are some steps you can take to shield yourself from scams:

- Stay informed: Learn from the experiences of scam victims, by putting yourself in the victim’s situation and considering how the controls you have in place could have protected you in their situation.

- Limit personal information sharing: Be cautious about the amount of personal information you share on social media ,and tighten your security settings. The less scammers know about you, the harder it is for them to craft convincing scams.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA for your online accounts. This adds an extra layer of security, making it significantly more difficult for scammers to gain access to your accounts.

- Have strong, unique passwords: Don’t underestimate the importance of strong, unique passwords for each of your online accounts. Consider using a reputable password manager to help you generate and store them securely.

Your data is your digital identity, and safeguarding it is vital. Scammers can use your data to gain trust, manipulate, and exploit vulnerabilities.

By taking steps to protect your data and sharing this knowledge with others, we can collectively defend against data-driven scams and build a safer digital world.

Vii and The Card Network (TCN) launch first-to-market eftpos digital gift card solution

Indue is excited to work with Vii and The Card Network (TCN) to launch our first-to-market eftpos digital gift card solution available through Apple Pay and Google Pay.

Our digital gift card technology supports growing customer demand for highly convenient, secure and flexible mobile payment experiences, reflected in the $6 billion value of the national gift card market in 2023.

Indue Chief Executive Officer Derek Weatherley said that digital gift cards offer benefits to both merchants and consumers, and enhances the digital gifting experience.

“We are thrilled to launch our eftpos digital gift card solution, which was first to the Australian market and will allow our clients to provide tailored, personable gifting experiences for their customers,” Mr Weatherley said.

“Digital gift cards enable online and instore purchases, are more secure and support environmental sustainability by eliminating plastic production and delivery.

“As highly customisable digital products that can be issued instantly, digital gift cards are a popular payment solution – both for givers and receivers of the card, as well as merchants who can access sophisticated back-end analytics to improve user experience and distribution.

Indue’s solution is driven via an issuer managed app, which facilitates the issuance of cards to TCN and Vii and allows them to maintain settings for the card and add it directly to an OEM wallet.

Our capability enables us to provide holistic support to card issuers in progressing their digital gift card products through Apple Pay and Google Pay, and we work with our client’s app developers to deliver a tailored solution.

Find out more about how we can help you today with our range of programs.

Insights from the Consumer Data Right Event Showcase

Indue’s Head of Innovation: Jenny Osborne attended the Consumer Data Right (CDR) conference featuring local and international experts, policy makers and founders who discussed the future of the CDR and showcased some exciting emerging use cases. There were ‘use case showcase‘ pitch-style session where founders presented about the CDR powered use cases they are building and bringing to market across payments, lending, climate tech, financial management, financial literacy. Some of the key takeaways from Jenny included:

The Consumer Data Right:

- allows consumers to safely share the data that businesses hold about them

- helps consumers compare between products and services to find offers that best match their needs

- encourages competition between providers, leading to more innovative products and services.

Currently CDR rolled out to Banking and Energy sectors, with plans to move to non-bank Lenders. There have been delays announced recently to the roll out for telecommunications, insurance and superannuation, with expectations it wont be reassessed until end 2024, this recommendation is in line with the independent statutory review that occurred citing the CDR needs time to mature. This also includes the implementation of action initiation, which will require a robust framework to support implementation.

To help CDR players understand the technical requirements ACC have introduced a new consumer data right portal to guide participants through technical requirements.

Keynote address: Australia’s Consumer Data-sharing Regime – A World-Leading Sanitation System for the Digital Economy

According to Scientia Professor Ross Buckley, UNSW it would have been better for Australia to start with simpler industries like Telecommunications or Insurance instead of Banking. He believed that Banking is a complex industry due to the high level of regulation and the large number of players involved.

The implementation process has been sluggish due to some participants exhibiting real inertia and resistance. Banks are also moving at a slow pace. Historically, banks have perceived customer data as their own and have been reluctant to relinquish control. Although many citizens believe that data pertaining to them should be theirs and not belong to banks or any other entity collecting it, privacy legislation supports this notion. However, legally, data is non-rivalrous and cannot be owned by anyone. Citizens have the right to control their data but not to own it.

The CDR will mature as more industries join and collaborate. However, without a formal regulatory regime, the absence of standards makes effective data sharing challenging. Limited data sharing will always constrain the growth of the digital economy. Therefore, it is essential for a policy agency to lead the process, rather than a regulator. An adaptable, living, and responsive framework is necessary for success.

According to his belief, the most prosperous companies view CDR as a data business and subsequently transform it into credit.

Data is the new oil – Globally the top 5 global companies pre-tax profit profile has shifted from all oil to a much bigger focus on Data companies (2 oils, 3 data companies) However, in Australia the top 5 companies are the same as 40 years ago.

Platforms – are the most profitable business model on planet, platforms are enhancing customer experience.

What has saved the most lives in the world? Water and sewerage systems – what can we learn from this? Bring clean, reliable data to business and dispose of unusable data responsibly.

In the UK Action Initiation has really accelerated. Action Initiation “Write access” provides consumers with the power to instruct accredited organisations to initiate actions on their behalf (current framework, consumers can only consent to accredited entities being given access to their data in read-only form).

Action Initiation allows products to become more customised based on risk/ behaviours to enrich the data. Although Consumer Data Right (CDR) presents both risks and opportunities for businesses, it can make options and switching simpler for consumers, and therefore, reducing the likelihood of retaining customers unless businesses are highly proactive in their customer-centric product offerings.

Governments have to bring change and encourage digital identity, driving the digital economy is critical.

CDR and the future of payments

The much anticipated ‘action initiation’ under the Consumer Data Right is on the way, with legislation in Parliament and fresh funding in the recent Federal Budget.

PayTo is a payment initiation system that falls under the Consumer Data Right (CDR). Consumers can use PayTo to kickstart payments and authorize them, with a unique feature of mandates permission. This system is compatible with CDR, and PayTo has mandates that allow others to debit your account, like in the case of gym memberships. This gives consumers the advantage of viewing, cancelling, and amending payments within the app, making subscriptions more manageable. However, there are still legal issues to consider, such as contractual obligations for a 12-month gym term. PayTo was created to replace Direct Debit and speedy fund transfers, but it doesn’t cover all use cases yet. Nevertheless, CDR can fill in the gaps where PayTo falls short.

Adopting NPP and PayTo has taken banks a significant amount of time, and it’s clear that initiating action will require more urgency and support. The regulator can play a critical role in encouraging banks to adopt these systems. While banks have eventually come around and are providing quality, compliant products, it’s important for the government and states to rally the banks. There’s a lot of interest in B2B opportunities for PayTo, like engaging companies for payroll, direct debits, improved controls, automation, and real-time movement of funds. For instance, a skydiving business could benefit from PayTo by reducing the risk of not receiving payment from a travel agent. Under NPP PayTo, the payment would be initiated immediately upon receipt of the coupon, reducing the risk. There are also opportunities for increasing process efficiency by reducing steps, friction, and time.

With PayTo, transferring payments from one bank to another for bill payments will be made possible. This is due to the increasing integration of payments through open data in the CDR system. AP+ recognizes that there is no clear set of rules on where CDR and PayTo begin and end and how they can be effectively merged. During discussions, there was a common theme of overlap between NPP/PayTo, CDR, and Digital Identity and the need for standardization with the involvement of the government and other stakeholders.

Delivering NPP PayTo – Ultradata and Indue Collaboration

In the ever-evolving world of financial services, innovation driven by consumer demand and Australian-mandated obligations continue to be the driving force pushing our businesses forward.

The PayTo initiative is a key part of the New Payments Platform (NPP) that is set to modernise direct debits, provide an alternative to card payments, and give customers greater control over their payments.

The system is designed to allow customers to manage recurring payments in bank apps and pay directly via bank accounts, and is designed to reduce payment costs for retailers.

Innovative Insights | Outstanding Outcome

“We feel that there is a commitment between Indue and Ultradata to work together in a way that is genuine and positive. There are a number of projects either in place or coming up, that we are partnering with Indue for. This is the way to achieve the best results.”

David Rowe, Senior Manager of Business Solutions at Ultradata

Recently a collaborative effort between Ultradata and Indue was taken to start the journey of delivering the PayTo gateway to Indue’s NPP participating client base.

The key deliverables for the project were:

- Meeting the NPP mandate.

- Creating and developing the NPP PayTo solution.

- Integrating the solution into Ultradata and Indue’s systems.

There were three key partners involved in the delivery of the NPP PayTo software solution:

- Ultradata

- Indue

- BankVic

Ultradata, crafting a user-friendly interface: Ultradata’s responsibilities included designing and developing the user interface, and assuring that the end product delivered a solution that met the industry requirements and exceeded customer expectations.

Indue, the NPP participant: Indue possessing a direct relationship with NPP Australia (NPPA) was pivotal to delivering a seamless NPP PayTo ecosystem, and held the responsibilities of defining, testing, and certifying the solution’s readiness.

BankVic, the Early Adopter: Ultradata and Indue were looking for a mutual client that had the experience and strong technical capability to onboard as an early adopter. BankVic was identified as a bank that had the right operating environment and had the prerequisites required to navigate the complexities of an early adopter, and one that would be able to integrate the NPP PayTo software within its core banking system, comprehensively test the product, and validate its functionality and usability within a specific timeframe.

“As the early adopter, I have seen, at times, 3 or 4 developers jumping onto a call to help us to work through some of the issues. As the early adopter we had Ultradata’s full attention. It was a real benefit.”

Gaetan Thillou, Project Manager, BankVic

Harnessing Knowledge | Leveraging Strengths

Since May, rigorous testing has paved the way for the solution to go into production, covering user acceptance testing and several phases of industry-specified testing, including testing with other industry partners. There was a multitude of steps and processes taken to deliver each early adopter milestone that respectively were aimed at meeting the outlined key deliverables.

By leading the way as an early adopter, BankVic not only tested NPP PayTo’s functionality in real-world scenarios, but also played a part in shaping the product to the direct needs of their business and to be compliant to the NPP requirements.

The lessons learned from BankVic’s early adoption have provided a blueprint for a smoother and more effective adoption process for Ultradata’s and Indue’s other mutual clients.

“The beauty about being in the mutual space is that it is a collaborative community; everyone is helping each other, with the early adaptor role for each project being shared amongst the mutuals. It provides a lot of benefits across the community.”

Gaetan Thillou, Project Manager at BankVic

The teams worked together to draw on the strengths of each other to make the solution even more innovative. One of these was Indue’s creation of a Test Portal to allow both Ultradata and the client to “self-serve” their testing needs by being able to create and update mandates as the initiator. Another was the provision of more user friendly display text in the Indue messages that includes simplified language and structure which is ready to be displayed as-is to the end-customer, eliminating the need for extra client-side processing.

Remarkable Teamwork | Collaborative Spirit

Given the complexity and challenges involved in developing and designing an innovative solution such as NPP PayTo, collaboration was critical to achieving a successful outcome.

Throughout each stage of project delivery, the partners brought their PayTo expertise to help identify and anticipate potential risks and challenges, and develop strategies to manage them.

For example, while the end-user experience might appear straightforward, the backend workings are significantly complex, and there can be varied interpretations of technical requirements and regulations.

Using their years of experience with developing payments solutions, the team successfully navigated this complexity through effective communication, open discussions, and a commitment to building a shared understanding among the partners.

Having a team with the right combination of skills and expertise has reminded us that collaboration truly is the cornerstone of overcoming challenges in order to achieve milestones.

“Working on the PayTo project was a very rewarding and positive experience. The open and honest working relationship between the three parties meant we could navigate through the challenges and achieve a great outcome for all our organisations,”

Simon Bromage, Project Manager at Indue.

Reshaping Payments | Transforming Transactions

Ultradata, Indue, and BankVic have helped pave a way for a future where other financial institutions will be in a position to empower their customers with more control over their bills, and payments, and stand to benefit from the way customers like to do their banking.

“I would like to thank Indue, Ultradata and Experteq for supporting and helping us through the project. The shared commitment and willingness to work together in order to deliver a positive outcome for BankVic members, is particularly pleasing.”

BankVic’s Chief Information Officer, Shane Kuret

The NPP PayTo is a product ready to reshape payment management.

Article produced by Ultradata – September 2023.

From days to minutes: Payment services provider Indue accelerates its ability to innovate using Azure

Indue has been a significant player in Australia’s payments sector for more than 50 years. The payments technology provider is an Authorised Deposit Taking institution who specialises in helping organisations of all types adapt to and benefit from the latest innovations in payments technology.

Through its solutions – which encompasses everything from card management and mobile payments to direct entry transactions and real-time fraud detection – Indue aims to eliminate the need for multiple third-party engagements and streamline the payment system implementation process.

Indue is a founding member of Australia’s New Payments Platform (NPP), launched in February 2018 to modernise the nation’s payment infrastructure. The platform enables faster, more flexible and data-rich transactions to meet the evolving needs of Australian consumers, businesses and financial institutions.

Keith Bromwich, Head of Architecture at Indue, says Indue has helped clients adopt the NPP since its inception.

“Our role is to allow tier 2 and 3 financial institutions such as mutuals, regional banks and BAAS providers to access the NPP via our own platform,” he explains.

In June 2023, the NPP introduced PayTo, a new digital way for merchants and businesses to initiate real-time payments from their customers’ bank accounts. PayTo solves many existing challenges with direct debit payments, including processing delays, limited transaction information, and a lack of control for consumers and businesses over payments.

To ensure it could help clients adopt the new payment method, Indue embarked on an ambitious project in March 2022 to transform its technology infrastructure – largely made up of on-premise data centres – and adopt a more cloud-native approach.

In May 2022, Indue engaged Microsoft partner Arinco to help it develop enterprise-scale landing zones and a robust application programming interface (API) platform in Azure.

“The people we worked with at Arinco were absolute knowledge leaders,” says Bromwich. “They helped us make the right decisions by providing the pros and cons.”

Arinco used a flexible delivery approach to facilitate development timelines, which saw the first application landing zones for PayTo being implemented by early July 2022. This enabled Indue’s developers to build new capabilities for testing by October 2022.

As this was Indue’s first major deployment of modern web APIs in Azure, Arinco supported and educated Indue’s developers and engineers by leveraging its partnership with Microsoft.

“Firstly, we embedded consultants within Indue’s development teams, focusing on accelerating outcomes and providing best practice guidance for topics such as .NET development, Azure API deployment and security,” says James Westall, Account Executive at Arinco.

“Secondly, our consultants worked with Indue’s platform engineers, sharing our expertise with them as we developed code for each landing zone. This meant that at transition time, Indue engineers were starting from a solid knowledge base.

“Lastly, we partnered with Microsoft to deliver hands-on Azure Accelerate workshops. These covered key topics identified by Indue, enabling employees to get familiar with Azure in a safe environment with instructor guidance.”

The other challenge that Arinco helped Indue solve was the operational sign-off of its Azure capability.

“As an entity that’s regulated by the Australian Prudential Regulation Authority, Indue must be able to attest to the security, stability and robustness of its services,” explains Westall. “The deployment that we developed was designed to remain compliant using Azure and third-party security tools, including the capability to hold Payment Card Industry data.

“We also assisted Indue in developing several operational documents and procedures, ensuring key details about running solutions on Azure were available for external auditors.”

Arinco’s accelerated approach enabled Indue to launch its PayTo integration within the tight timeframe and begin onboarding clients in June 2023.

Enhancing innovation in the cloud

While Indue is still in the early stages of its cloud journey, its event-driven architecture in Azure is already delivering benefits. These include increased flexibility and scalability, which enable Indue’s developers and engineers to deploy any project – not just PayTo – in the cloud much faster and move from business idea to development workload in minutes or hours rather than days.

“The innovation piece is a key focus for Indue and its customers,” says Ryan Spain, Chief Information Officer at Indue. “Leveraging cloud-based technologies like Azure gives us access to a much wider variety of innovative capabilities in a fraction of the time compared to on-premise, and enhances the products and services we can offer.”

Indue’s move to the cloud has also helped them simplify its technology stack and reduce operational costs. Transitioning its Corporate Services (Virtual Desktop, remote access, and Office environment) to the Azure Virtual Desktop capability which operates within the enterprise-scale landing zone structure.

Now, key personnel can focus more on value-adding tasks rather than maintaining the performance and security of Indue’s hardware and software.

“We don’t have to worry about data centre connectivity or patching. All of that low-level maintenance is done by Microsoft,” says Bromwich.

Indue plans to grow its cloud footprint in Azure by kicking off two other major projects in 2023. One will focus on implementing a big data lake that leverages Microsoft’s advanced analytics capabilities. The other project will focus on migrating Indue’s on-premise Microsoft Dynamics 365 platform to Azure. Both projects will further enhance Indues’ ability to deliver innovative payment solutions and a better customer experience, according to Spain.

“This is a strategic partnership with Microsoft,” he says. “They’ve been on the journey with us from the start, and we really appreciate the assistance and guidance they’ve provided. The partnership has been a key enabler for facilitating both the PayTo integration and our broader cloud strategy.”

Source: Microsoft News 30 June 2023

We’ve launched our PayTo service offering

Indue is excited to announce the official launch of its PayTo service offering, enabling financial institutions and payment service providers and platforms to drive payment innovation and improved customer experiences.

A development of Australian Payments Plus on it’s New Payments Platform (NPP), PayTo modernises the way bank accounts are used for payments, helping businesses and consumers thrive in the digital economy.

Indue CEO Derek Weatherley said the PayTo launch is a natural extension of Indue’s NPP capability, which has been helping Australia’s leading mutual and community banks take advantage of flexible, real-time payments with industry-leading financial crime support since 2018.

“At Indue, we are committed to investing in product technology advancements that support our client’s digital transformation, innovation, and competitiveness, exemplified now through PayTo,” Mr Weatherley said.

“We have a team of NPP experts that have already begun to connect partners to PayTo, delivering them a faster, simpler, and smarter real-time payment service.

“We are thrilled to be part of the PayTo revolution and, as always, are keen to help our current and future customers keep pace with the changing Australian payments landscape.

“PayTo will enable a superior payment experience by streamlining payments and improving efficiency and control for consumers and businesses. This is achieved by PayTo while at the same time reducing risks and modernising the way money moves.

“Ultimately, PayTo further enhances Indue’s digital banking offering, providing a state-of-the-art payment services experience for our customers.”

Indue can connect financial institutions, payment service providers and platforms to PayTo .

To learn more and get PayTo ready, click here.

Meet Head of Innovation – Jennifer Osborne

We sat down with our recently appointed Head of Innovation Jennifer Osborne for an insightful interview about her new role, Indue’s future, and the payments industry at large. Read what she had to say below.

WHY DO YOU THINK INDUE HAS INTRODUCED THIS ROLE?

Innovation is intrinsically linked to growth and business value, making it an essential ability amidst the disruption and change facing the payments sector today. To meet Indue’s core purpose of helping our customers drive their own competitive advantage, it’s essential we keep our product offering strong by staying on top of what’s in the pipeline. I believe Indue introduced this role as a way of continuing to meet our customer’s needs by bringing the wider community together to leverage knowledge and drive opportunity.

HOW HAS YOUR BACKGROUND PREPARED YOU FOR THIS ROLE?

I have worked across a variety of industries in my career, including financial services. That means I am coming to this role with an established understanding of the breadth and scale of the challenges that a lot of our customers face. From customer experience and operations to strategic portfolio delivery, I understand the banking lifecycle. I think my deep customer knowledge will set the tone for what I do in the innovation space at Indue. The customer always has and always will be at the core of our work.

WHAT IS YOUR VISION FOR THE ROLE?

As I mentioned, there is huge disruption and opportunity in our industry. My vision for the role is that we provide insights and guidance on evolving opportunities, driving a purposeful, customer-centric roadmap of innovative change through collaboration with our community.

SPEAKING OF OPPORTUNITY, WHAT DO YOU BELIEVE IS THE MOST NOTEABLE POSSIBILITY FOR INNOVATION IN THE PAYMENTS, FINANCIAL SERVICES, AND BANKING SECTOR?

There has been, and continues to be, a strong emphasis on digitisation and operational efficiencies. People these days are time poor and generally more impatient, meaning we have the opportunity to streamline and improve customer experiences.

CONVERSLEY, WHAT DO YOU THINK THE MOST SIGNIFICANT CHALLENGES TO INNOVATION IN THIS SECTOR ARE?

For the financial services and payments sector particularly, I think we’re seeing a significant change of pace and increasing cost of doing business. Customers are more informed now, demanding a different proposition. Data and security are front of mind, posing the difficulty of digitising services while keeping them exceptionally safe. At the same time, services need to remain easy to understand and adopt, as well as cost-efficient. It’s all a balancing act.

WHAT ARE THE THREE MAIN AREAS YOU INTEND TO FOCUS ON IN THIS ROLE OVER THE NEXT 12 MONTHS?

I think my focus areas can be summarised as three questions:

- What is the market doing?

- What are our customers trying to achieve?

- What opportunities exist to help them succeed?

Essentially, I hope to provide market insights and thought leadership at an aggregate level, understanding our customers challenges and delivering on the opportunities out there.

HOW DO YOU FORSEE INNOVATION ALIGING WITH AND CONTRIBUTING TO POSITVE SOCIAL AND ENVIRONMENTAL IMPACTS AT INDUE?

Change is inevitable, we just need to ensure it’s for the good of our people and our planet. Innovation and disruption are therefore required. I see Indue’s work aligning with that – we’re very conscious of and committed to ESG. We serve our diverse customers and communities through a variety of sustainable and social innovations, for example through our environmentally friendly bank cards and our accessibility offerings for visually impaired end-users.

WHERE DO YOU HOPE TO SEE INDUE IN 5 YEARS TIME?

There is so much knowledge and passion across us and our customers that the future is extremely exciting. We’re keen to grow and consolidate loyal partnerships with our customers, cultivating a highly connected community who maximise and optimise, together. Through our focus on and commitment to our customer’s purpose, I hope we continue to prove ourselves as the provider of choice.

DESCRIBE WHAT INNOVATION MEANS TO YOU.

The age-old question… innovation means different things to different people! For me, it’s about bringing renewed focus to optimise strategies. That might be through small incremental changes or more disruptive means, but either way it will deliver value in a customer-centric and sustainable way.

The Mutual Bank Partnership

For 135 years, The Mutual Bank has met the financial needs of the Maitland, Newcastle, and Hunter communities in New South Wales, serving and supporting them in building a sustainable future.

Since March 2022, Indue has provided The Mutual Bank and its members with a significantly expanded payment services suite, including Direct Entry, BPAY, NPP, Financial Crimes, Anti-money laundering, Card Services, High Value Payments, and an expansion of its Digital Payments offering.

The Mutual Bank CEO Geoff Seccombe said the partnership continues to be driven by a strong alignment in company values, product offerings, and payment needs.

“Our relationship with Indue began when we needed assistance in becoming the first local mutual bank issuer of Apple Pay in the region. But it is founded upon much more than a vested interest in innovative payments technology,” Mr Seccombe said.

“Indue earned our trust, respect, and business by delivering on its payment services promise, and it has kept it by continuing to share our community-first focus and partnership culture.

“I commend Indue for its support of the local communities in which we operate, and its unwavering commitment to environmental, social, and cultural initiatives,” Mr Seccombe said.

Indue CEO Derek Weatherley said that alignment with our clients’ sustainability practices, community programs, and employee wellbeing are core to our values.

“The best partnerships are achieved when company culture and core values align, which is what we have experienced with The Mutual Bank,” Mr Weatherley said.

“We have an excellent understanding of The Mutual Bank’s priorities and their wider community goals in operating in a socially responsible manner, prioritising positive social impact and a genuine ‘one team’ support model with on-the-ground support.

“We look forward to continuing to work with The Mutual Bank and its community” Mr Weatherley said.

Orion protects Bank of us Customers

Tasmania’s Bank of us and its customers are reaping the significant fraud protection benefits of Indue’s Orion Financial Crimes Service, delivered as part of our exclusive full-service payments partnership.

As an agile solution that enables safer payments, ‘Orion’ offers real time, non-stop fraud detection, monitoring, and management through integrated AI machine learning.

Bank of us CEO, Paul Ranson said outsourcing payment services to Indue, including financial crime solutions and the provision of aggregated insights, predictability, and forewarning, has been of major benefit to the customer-owned bank.

“With Orion, more fraud cases are being detected and deterred before they hit accounts, drastically reducing our volume of disputes while simultaneously increasing our customer satisfaction and security,” Mr Ranson said.

“On the rare occasion fraud has transpired in the last 3 months since transitioning to a full-service partnership, Indue’s service has been incredible at enabling chargebacks to occur promptly, putting money back in our customers wallets faster.

“The necessity and truly incredible value of this service for Bank of us was illustrated when, on the first day of Orion’s operation at our bank, it saved just one of our customers $25,000.”

Indue CEO Derek Weatherley said the Orion service demonstrates industry-leading performance in financial crimes prevention, effectively reducing the burden on the non-major banks that we protect and serve, such as Bank of us.

“With more than 2.4 million accounts under management, Orion has access to a large pool of transactional data to detect trends, with rules tailored to meet the needs of individual organisations like Bank of us,” Mr Weatherley said.

“Our Australian-based team of fraud analysts do the heavy lifting, freeing up Bank of us to do the things they’re good at, like great banking products and services to Tasmanians, with enhanced peace of mind, knowing we’ve got them covered.

“For both Indue and Bank of us, who prioritise and care for customers, the reliable payments protection Orion provides is all that much more important.”

Beyond Orion, Indue’s range of services include the New Payments Platform, prepaid and gift card programs, mobile payments, the Nucleus Card Platform, and Payment and Bureau Services.

Bank of us upgrades fraud monitoring with Indue

As it targets August migration deadline.

Bank of us, a Tasmanian customer-owned institution, has signed Indue to upgrade its fraud monitoring, as it works through a broader payment migration project set for completion this August.

Bank of us has a retail presence in Tasmania and 33,000 customers.

The bank stated earlier this year it had invested in an upgrade to its fraud monitoring service, aimed at building greater protection for customer funds.

CEO Paul Ranson told iTnews the bank appointed Indue “as our exclusive full-service payments partner, which has included the adoption of Indue’s Orion financial crimes service.”

“The Orion financial crimes service monitors all card transactions in real-time, allowing for most fraudulent transactions to be detected and blocked before they hit our customer accounts,” Ranson said.

“The service will continue to be expanded to cover all other payment types from May,” he said, adding the financial crimes service is powered IBM’s safer payments platform.

He said since the upgrades, the bank has noted “a significant reduction in the number of fraudulent transactions affecting our customer accounts.”

Implementation of the financial crimes feature is part of a bigger project, kicked off last October, to migrate payment and settlement services over to Indue.

The project is expected to be completed by August 2023 and give customers access to more sophisticated end-to-end payment solutions.

Source: IT News, Apr 14, 2023:

Indue Upgrades High Value Payment Processing Capability

21st March, 2023

Indue is excited to welcome in the next era of high value payments processing, as the industry reached a significant milestone this week with a major multi-year upgrade to ISO20022 messaging standards, to future-proof the payments system and enable domestic and international payment system interoperability and data-rich messaging.

In conjunction with the rollout of this major industry upgrade, Indue has enhanced its high value payment processing technologies to maximise the operational efficiencies and security posture of the system.

Indue Chief Executive Officer Derek Weatherley said these new messaging standards will bring many benefits for customers and their operational staff, such as improved financial crime monitoring, rich data and international harmonisation via the SWIFT network.

“We have kept clients front of mind while redeveloping our high-value payment processing capabilities to ensure they capitalise on the value of the technology,” Mr Weatherley said.

“Among many benefits, our clients will have access to streamlined end-to-end processing and full self-service capabilities through the online portal that enables real-time transaction tracking, approval and auditing.

“The upgrades also support API messaging for updates, notifications and other functions, automated approval processes, significantly lowering operating costs and risks, as well as modernising the overall security posture, including multi factor authentication.

“Our processing capabilities align with the ISO20022 upgrades to ensure our clients can enjoy greater operational efficiencies, and we look forward to driving faster payment experiences with the roll-out of these technologies.”

The upgrade was launched with Auswide Bank in March 2023, with an iterative roll-out across our full client base underway.

Auswide Bank Partnership

21st March, 2023

Following the successful launch of a New Payments Platform (NPP) for Auswide Bank in 2022, Indue and Auswide have been busy behind the scenes to successfully implement Direct Entry, BPAY, Cards as well as Anti-Money Laundering (AML) and High Value payment capabilities.

Throughout the past year, Indue has enabled digital transformation, state-of-the-art customer experiences, and improved business outcomes for Auswide Bank, enabling them to best help achieve their goals of helping Australians achieve home ownership, create wealth, and access banking and financial services.

Auswide Bank Managing Director and CEO Martin Barrett said that Indue’s similar commitment to prioritising customers has assisted in delivering outstanding services to Auswide Bank communities and customers across the country.

“Indue’s full suite of end-to-end payment solutions are a key component of transforming our business with technology and providing digital payment choices for our customers, improving their experience and delivering stronger business outcomes,” Mr Barrett said.

“Efficiencies that have flowed through our operations as a direct result of Indue’s integrated service stack have exceeded all expectations – it is fantastic to have a partner with modern technology that does the heavy lifting for us”.

Indue CEO Derek Weatherley said “I am very pleased that this transition has closed so quickly and cleanly and my team remains energised to support Auswide Bank in bringing these services to their customers.”

“Since Indue’s appointment as Auswide Bank’s exclusive full-service payments partner earlier, we have expedited the implementation of NPP, Direct Entry, BPAY, Cards, AML and High Value payments” Mr Weatherley said.

“As a founding member of the NPP, our partnership with Auswide Bank enables the organisation and their customers to securely send and receive payments with other financial institutions in near real-time.

“Complementary to this, Direct Entry and BPAY provide cost-effective, convenient ways for customers to transfer funds between bank accounts and pay bills. The Indue and Auswide Bank relationship has been further enhanced by simple and adaptable payment card and mobile payment services, including switching and settlement, which provide maximum flexibility for Auswide Bank and their customers.

“The efficient and seamless implementation of these offerings demonstrates Indue’s industry-leading knowledge and ability to deliver cutting-edge integrated solutions to our customers.

“We are proud of the significant operational efficiencies that Indue’s integrated payment systems provide to Auswide Bank freeing staff up to focus on serving their customers and community. We very much look forward to continuing our successful partnership.”

Qudos Bank selects Indue as their principal payments partner

We are delighted to confirm that Qudos Bank has reappointed Indue as their exclusive full-service payments partner.

Qudos Bank is one of Australia’s largest customer-owned banks with branches in Sydney, Melbourne and Brisbane and more than $5 billion in assets, offering a full range of financial products and services, including home loans, personal loans, transaction, and savings accounts, super and investing, and insurance.

Over recent years Qudos Bank has been on a digital transformation journey and provides a host of exceptional digital banking platforms and payments services. Qudos Bank CEO Michael Anastasi said the relationship renewal reaffirmed the strength and value of the long-term partnership with Indue to provide end-to-end payment services.

“We have a long term partnership with Indue and renewing the relationship supports continuing development in our innovation around digital banking offering and providing a state-of-the-art payment services experience for our customers, underpinned by market leading security in payments for our customers” Mr Anastasi said.

“Importantly, Indue’s customer-focussed culture is outstanding across the organisation and directly aligns to our central focus as a customer-owned bank on delivering banking services in the interests of our customers, providing synergies that will help Qudos remain at the forefront of excellent in customer service standards for our customers across Australia.”

Indue CEO Derek Weatherley said the renewal of the partnership will enable Qudos Bank to provide to their customers a comprehensive suite of end-to-end payment services coupled with market leading payment security. Qudos has been remarkably successful through a laser focus on customer advocacy and being easy to do business with – the partnership with Indue ensures that excellence in customer outcomes remains at the forefront of their business operations.

“Indue remains heavily invested in advancements in our product technology capability, reinvesting our profits into research and development via our Innovation Hub and the various working groups it supports and continuing to support the digital transition of our clients,” Mr Weatherley said.

“We couldn’t be more pleased Qudos Bank has chosen to extend our long-term partnership and we are looking forward to working together to build out future innovation pathways for real time, data rich, frictionless payment choices for customers. Qudos has been a great supporter of their community and we look forward to working closely with Qudos this year on supporting and driving community focused outcomes important to their organisation.

“The payment products and services suite provided to Qudos Bank by Indue will include NPP, PayID & Pay To, mobile payments, Orion Financial Crimes, Cards, Direct Entry, and BPAY services.”

-ENDS-

id8 Tour | Money 20/20 Diversity & Culture

The Money20/20 conference has given us the opportunity to hear from a wide range of world-class speakers, including global entrepreneurs and even a Grand Slam tennis champion, who have all touched on the intrinsic link between organisational culture, diversity, and performance.

The companies that are best positioned to establish a competitive edge are the ones that embrace a culture of prioritising diversity of people and thought, and equally, this diversity is the best form of due diligence when developing new business models or entering new markets.

In a broad ranging discussion about fintech and start-ups featuring Serena Williams, we heard about new business models and solutions that are focused on solving problems for customers, leveraging the power of partnerships, and driving a competitive edge through organisational culture embracing diversity.

We were also fortunate to hear from several women who have founded new payment fintech companies in the past two years, including Kontempo – a Mexico-based bank focused on providing credit to small businesses, Lucy – which is providing funding for female entrepreneurs, and the competitive edge through embracing diversity was a recurring theme.

The theme of modernising core was prevalent, ensuring foundations are built on future proofed architecture. Another common theme in this vein was ‘build core, partner everything else’. This includes leveraging partnerships for insightful and innovative product design, and the theme of diversity featured again through partnerships that support organisational diversity, with a US Bank focussing a commitment to diversity though partnering with fintechs who are focused on minority/women only businesses.

Indue Customers Benefit from Fiserv Payment Switch Upgrade

Indue customers can now enjoy the benefits of a state-of-the art payment switch, following a major hardware and software upgrade to the transaction switching platform from Fiserv in Australia.

The new platform will greatly enhance Indue’s ability to deliver fast, convenient and consistent service to customers.

Indue Chief Delivery Officer Kevin Lugg said the major benefits of the upgrade include scalability, improved capability and functionality, access to industry compliance updates, API enablement, as well as providing a more flexible, interoperable connectivity into the Fiserv payments ecosystem.

“Upgrading the existing platform to the latest version of payment switching software and state-of-the-art hardware infrastructure provides a highly scalable, reliable and secure payment solution for Indue customers.

“The upgrade provides customers with a single, cost-effective and versatile transaction switch, reducing complexity and compliance overhead and ensuring scalable delivery to support future growth.

“The platform provides tandem non-stop capability and great mirroring, resulting in less down-time, and sets a solid foundation that enables Indue to further support customers as they move into the next phase of their digital journey.

“Customers can increase throughput seamlessly without the need for additional upgrades or investment because the platform immediately provides additional transaction processing on demand.

“It also provides access to out of the box API servers, with enhanced API architecture that will establish a standardised integration framework to enable ease of integration with digital channels in the future.”

Mr Lugg said it was critical for the Indue team to work collaboratively with strategic partner Fiserv, customers and partners to achieve a successful implementation of the upgrade.

“Upgrades to a platform such as this can only be successful with a highly collaborative approach and in this case involved a multi-week effort by Fiserv, Indue and its customers and partners across a series of geographically dispersed command centres.

“Indue worked closely with our strategic partner Fiserv and customers with a lead-in period of testing followed by a lead-out phase involving combined command centres to test all services, products and capability.

Indue is proud to partner with Fiserv, a leading global provider of financial services technology, to provide our customers with a dependable, fully integrated, end-to-end payment switch solution to meet their complex transaction processing requirements.

Indue Delivers Rapid NPP Implementation For Auswide Bank

Auswide Bank customers can now send and receive payments with other financial institutions in near real-time, following the successful launch of a New Payments Platform (NPP) offering by Indue.

Indue Chief Customer Officer Fred Perry said the implementation of NPP for Auswide Bank was remarkable due to its rapid speed to market and seamless delivery.

“Since Indue’s appointment as Auswide Bank’s exclusive full-service payments partner earlier in 2022, we have worked tirelessly to expedite this NPP implementation in addition to our DE and BPAY services,” Mr Perry said.

“As a result, the platform was launched in less than three months.

“The real key to completing the full NPP implementation so quickly, while ensuring the platform integrated seamlessly into Auswide’s current banking offering, was the strong collaboration between the Indue and Auswide Bank teams.

“The launch of NPP for Auswide demonstrates Indue’s ability to deliver integrated solutions efficiently and seamlessly to our customers, with industry-leading knowledge of the technical

and regulatory requirements needed to successfully complete a full NPP implementation.”

Auswide Bank Chief Customer Officer, Damian Hearne, said the implementation of the NPP for customers has been highly anticipated and will be a game-changer for every-day banking needs.

“The New Payments Platform really brings banking in-line with the way people operate on a day-to-day basis. Our expectations for sending and receiving information are aligned to the internet and the digital applications we use each day. The NPP will allow our customers to perform their banking requirements faster, smarter and more securely without the stress of when funds will arrive.”

Indue remains committed to supporting our customers through their digital transformations and providing state-of-the-art customer experiences and business outcomes.

Indue gains ISO certification for information security management

Payment solutions provider Indue today announced it had received an International Organization for Standardisation (ISO) 270001:2013 certification for information security management — one of the

most widely recognised and internationally accepted standards for the security of assets.

The ISO certification features requirements on how to implement, monitor, maintain and continually improve an Information Security Management System (ISMS) in accordance with the standard,

including preserving the confidentiality, integrity and availability of information to ensure risks are adequately managed.

Indue Chief Executive Officer Derek Weatherley said the accreditation reinforces the organisation’s proven security processes and credentials against the global standard.

“This is a significant achievement for Indue, which specialises in helping customers gain competitive advantage through innovative payment solutions,” Mr Weatherley said.

“The certification strengthens our approach to information security, and demonstrates to our customers and partners that we maintain the highest levels of data security.

“We are trusted by our customers to store and process their most valuable data, so this certification provides assurance that we have all the necessary controls in place to ensure this important information is protected.

“Particularly in the context of COVID-19 where we’ve seen an increase in the risk of data security breaches alongside a surge in online transactions, we’ve continued to demonstrate our commitment to secure payment products, supported by rigorous compliance, program oversight and our transaction monitoring and protection system, Orion Financial Crimes.”

Data security has never been more important, with COVID-19 restrictions forcing many businesses to move to remote data almost overnight, significantly increasing the risk of data breaches.

By implementing and following the necessary steps to comply with the ISO 27001:2013 standard, organisations can identify, control and eliminate security risks, ultimately certifying the security practices adopted within the organisation.

ISO is an independent, non-governmental, international organisation that develops standards to ensure the quality, safety and efficiency of products, services and systems.

Indue appoints accomplished business leaders to the Board

Indue appoints accomplished business leaders to the Board

Leading banking payments, financial crime management and technology services company Indue

Limited has today announced the appointment of accomplished business leaders Susan Rix AM and

Abigail Cheadle as new independent non-executive Directors to its Board.

Their appointments follow the retirement of current Board members Robin Burns and Sally Collier.

Ms Rix and Ms Cheadle join the Board in January 2021.

Ms Rix is a tax and advisory partner with BDO in Brisbane and has had a distinguished career in

corporate advisory and non-executive roles across numerous sectors spanning more than 35 years.

Her current Board roles include Chair of Harcourts Group, Queensland Performing Arts Trust (Chair of

Risk Management and Audit Committee) and Chair of AEIOU Foundation. Ms Rix is also a

Queensland University of Technology Council Member and Business School Adjunct Professor. Her

previous Board roles have included Queensland Rail (Chair of the Audit and Risk Committee), Port of

Brisbane Corporation and Mater Misericordiae Ltd.

Her experience includes the various aspects of commercial, financial and taxation matters.

Ms Cheadle is an accomplished corporate advisor, executive and non-executive Director with

experience growing finance, services and technology companies.

She spent 17 years of her 27 year career in Asia where she held executive positions with Kroll (head

of investigations for Asia), KordaMentha (partner in charge of Forensics), Deloitte (head of Singapore

Forensic), and Ernst & Young(Forensic Accounting service line leader for Asia Pacific). She is

presently non-executive Director and Chair of Audit and Risk Committee for two ASX listed

companies, namely: Isentia Group Ltd and Shriro Holdings Ltd. Ms Cheadle was previously a non-

executive Director and Chair of the Audit, Risk and Compliance Committee for two other ASX listed

companies, namely: QANTM Intellectual Property Ltd and SurfStitch Group Ltd.

Indue Chair Frank Gullone welcomed Ms Cheadle and Ms Rix to the Board, and said he looked

forward to their contribution and the opportunity to leverage their depth of corporate experience.

“Together, they bring to the Board outstanding and relevant experience, and deep expertise in

business strategy, transformation, risk and governance.

“Susan and Abigail’s diverse backgrounds and skills will further strengthen the Indue Board and

complement the expertise of the existing Directors in the strategic development of the company.

Indue appoints new Independent Director

Indue appoints new Independent Director

Leading payments, financial crime management and technology services company Indue Limited has announced Tim Oldham will join the Board as a non-executive Director on 27 September 2021

Mr Oldham is a highly credentialled Australian non-executive Director and currently serves on the Boards of Bank of China Australia and Waves of Wellness Foundation He is a retained advisor to Barwon Investment Partners, chairing its Risk and Compliance Committee. He has previously been a non-executive Director of Vietnam International Bank

As a former senior banking executive, he has deep experience across credit, operational, market, compliance, liquidity and business risk, including risk governance leadership.

Over the past 25 years, Mr Oldham has had a strong focus on risk management in financial services, both as a practitioner and as a consultant.

Most recently he was Chief Risk Officer for CBA’s International Financial Services division based in Hong Kong with oversight of banking and insurance businesses in China, Vietnam, South Africa, and Indonesia.

Prior to that he was lead partner for Deloitte Australia’s financial services risk advisory practice for four years, and was Head of Business Risk and Credit Strategy for Westpac’s Institutional Bank for three years. Earlier he was with Macquarie Group for 16 years, acting as an advisor on risk to Macquarie’s corporate and government clients, and as a Division Director in Macquarie’s Risk Management Group.

Commenting on Mr Oldham’s appointment, Indue Chairman Mr Frank Gullone said: “Tim will bring a wealth of banking experience gained in Australia and overseas. His specific background in risk management will add further depth to Indue’s solid base in the area.”

ENDS

For more information please contact:

Clare Mitchell, Senior Marketing Manager, Indue Limited E: [email protected]

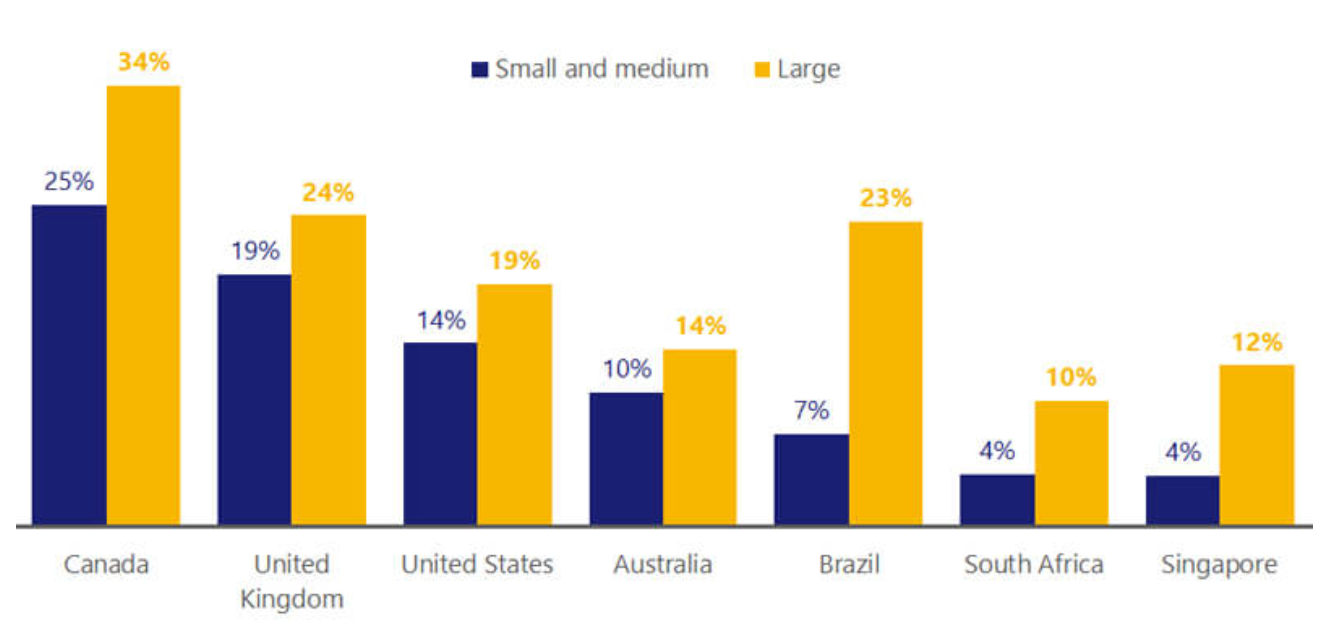

Retail merchants of all sizes across all regions of the world adapted to the pandemic by moving more of their sales online

Will the abrupt, pandemic-induced e-commerce shift reshape retail’s future?

Retail merchants of all sizes across all regions of the world adapted to the pandemic by moving more of their sales online.

Last year as millions sheltered at home, e-commerce proved crucial to keeping retail sales flowing. Now, as outbreaks begin to subside and mobility returns, e-commerce’s share of total sales has fallen from its 2020 peak, raising questions about the lasting impact of the abrupt shift to e-commerce.

Transaction data offer two reasons for optimism that the accelerated uptake in online selling will persist even after the pandemic. First, the digital revolution now extends beyond large digital goods merchants to include more small and medium-sized businesses (SMBs). Second, SMBs that enhanced their digital offerings in 2020 now have a distinct advantage. Expanded sales channels have led to enlarged customer bases and provided a firm basis for the continued development of digital capabilities.

Online sales should settle on a new (higher) normal

Evidence from Australia and Singapore indicates that e-commerce gains are sustained even after outbreaks are brought under control. In both countries, local transmission of the novel coronavirus largely ended late last year and consumers’ visits to retail outlets soon recovered. Greater mobility helped brick-and-mortar retail sales to rebound, yet online sales as a share of the total remain 3 to 5 percentage points higher than prior to the pandemic.

Achieving a similar expansion in online sales prior to the pandemic would have taken between four to five years based on previous adoption rates in these countries. Years of development were compressed into a single year, leaving consumers more familiar with buying online and merchants with new sales channels.

2020: The year retail merchants of all sizes went digital

According to our analysis of VisaNet data, retail merchants of all sizes across all regions of the world adapted to the lock-downs and pandemic by moving more of their sales online.¹ While the shift was more pronounced for large businesses, SMBs were not far behind. In Canada, for example, while one in three large businesses pivoted to expand their online sales, one in four small businesses did the same. Adaptations to survive the pandemic and investments made last year have opened up new channels for merchants of all sizes to reach consumers in more ways.

Interestingly, transaction data further shows that half of the increase in SMB online sales last year came from businesses that had no or minimal online business before COVID-19. Prior to the pandemic, three out of every five small Visa SMB retailers had no online sales in 2019. Responding to the challenges from the pandemic, 7 percent of these firms made their first online sales in 2020. Though traditional brick-and-mortar retail remains the main channel for sales among small businesses, the pandemic has accelerated the pace of adoption of digital channels.

These first-time participants showed strong returns on the investment, with their sales as much as 20-30 percentage points higher than their peers who did not shift to digital selling. Moreover, digitally-enabled SMBs emerged from the pandemic more resilient to lockdowns. Of these newly-online merchants, 86 percent were able to stay open in 2020 with limited closures, compared to just 70 percent of their peers with offline-only sales who managed to avoid extended periods of inactivity during the year. The secret to their success was in the wider markets these newly digitally-enabled firms enjoyed—markets that were opened to them through e-commerce and electronic payments.

Through digital channels, SMBs reached a larger pool of customers

Digitally-enabled merchants were able to drive stronger sales as the shift online expanded their customer base.² Prior to the pandemic, online sales accounted for less than 20 percent of all sales for the majority of retail SMBs in countries around the world. This limited their reach to customers within a set geographic radius around their physical stores. Moving online opened up markets that previously may have been unreachable before the pandemic.

Within the subset of SMBs that had at most 20 percent of their sales online in 2019, those that increased their online throughput in 2020 experienced a 14 percent increase in customers compared to a 3 percent decline for those that stayed offline, according to the VisaNet analysis. In fact, the growth advantage that small businesses with expanded digital channels have over their peers can be almost entirely attributed to their relative success in attracting new customers. In the United States in particular, SMBs that did not increase their online presence lost about 4 percent of their customers, whereas those that did enjoyed a 1 percent expansion.

This shift to online also coincides with a shift in consumer preferences in favor of online shopping. A recent Cybersource study reported³ that mixed-channel retailers received the highest customer satisfaction scores, compared to merchants that had either exclusively-online or brick-and-mortar sales channels. The COVID year has already left a lasting imprint on small businesses. Vaccine rollout delays or broader spread of new COVID-19 variants would likely only reinforce and accentuate the digital transformation and deep technological shift in retail that was precipitated by the pandemic.

More highlights:

- A few years’ worth of e-commerce gains were compressed in a single year

- Retail’s digital transformation extends to small and medium-sized businesses

- Adding an online channel helped businesses reach a larger set of customers

- COVID-19’s economic Impact Index

Read the complete March Global Economic Insights report

Footnotes:

- ¹ Analysis is based on a sample of about 3 million Visa merchants located in 25 markets around the world. The sample includes the subset of Visa merchants in the retail trade category (excluding gas stations and food service establishments) that were minimally active in both 2019 and 2020. A merchant’s segment is defined based on the merchant category code where it registered the largest purchase volume in 2019. Small- and medium-sized businesses are defined as having total purchase volume in 2019 that was not within the top quartile of all Visa merchants within the same market and merchant category. Online transactions in this document are card-not-present transactions.

- ² A merchant’s client base is measured by the unique count of Visa cards that made domestic purchases at that merchant during the calendar year.

- ³ Cybersource 2020 Global Shopping Index Report.

Source: Visa Global Perspectives, April 9 2021.

Listen up: Payments Australia Podcast

Listen up: Payments Australia Podcast

Featuring Dave Hemingway Chief Commercial Officer

Join Dave Hemingway as he shares his insights on the evolution of Indue and the challenges currently being faced, alongside his notable career journey through payments.

Indue appoints accomplished business leaders to the Board

Indue appoints accomplished business leaders to the Board

Leading banking payments, financial crime management and technology services company Indue Limited has announced the appointment of accomplished business leaders Susan Rix AM and Abigail Cheadle as new independent non-executive Directors to its Board.

Their appointments follow the retirement of current Board members Robin Burns and Sally Collier.

Ms Rix and Ms Cheadle join the Board in January 2021.

Ms Rix is a tax and advisory partner with BDO in Brisbane and has had a distinguished career in corporate advisory and non-executive roles across numerous sectors spanning more than 35 years.

Her current Board roles include Chair of Harcourts Group, Queensland Performing Arts Trust (Chair of Risk Management and Audit Committee) and Chair of AEIOU Foundation. Ms Rix is also a Queensland University of Technology Council Member and Business School Adjunct Professor. Her previous Board roles have included Queensland Rail (Chair of the Audit and Risk Committee), Port of Brisbane Corporation and Mater Misericordiae Ltd.

Her experience includes the various aspects of commercial, financial and taxation matters.

Ms Cheadle is an accomplished corporate advisor, executive and non-executive Director with experience growing finance, services and technology companies.

She spent 17 years of her 27 year career in Asia where she held executive positions with Kroll (head of investigations for Asia), KordaMentha (partner in charge of Forensics), Deloitte (head of Singapore Forensic), and Ernst & Young(Forensic Accounting service line leader for Asia Pacific). She is presently non-executive Director and Chair of Audit and Risk Committee for two ASX listed companies, namely: Isentia Group Ltd and Shriro Holdings Ltd. Ms Cheadle was previously a nonexecutive Director and Chair of the Audit, Risk and Compliance Committee for two other ASX listed companies, namely: QANTM Intellectual Property Ltd and SurfStitch Group Ltd.

Indue Chair Frank Gullone welcomed Ms Cheadle and Ms Rix to the Board, and said he looked forward to their contribution and the opportunity to leverage their depth of corporate experience.

“Together, they bring to the Board outstanding and relevant experience, and deep expertise in business strategy, transformation, risk and governance.

“Susan and Abigail’s diverse backgrounds and skills will further strengthen the Indue Board and complement the expertise of the existing Directors in the strategic development of the company.”

ENDS

For more information please contact:

Clare Mitchell, Senior Marketing Manager, Indue Limited E: [email protected]

Stay COVID-safe with contactless giving | Indue Digital Gift Card

Stay COVID-safe with Contactless Giving

Contactless payment methods have never been more important. The ‘tap-and-pay’ approach to purchasing everyday essentials has well and truly become the norm, with the global pandemic forcing us to rethink our daily movements, including how we choose to pay.

The Rise of Contactless Payments

The rise of contactless payments can be seen right across the sector, made even more accessible following the temporary increase of PIN limits for contactless payments from $100 to $200 to reduce the need for physical contact with payment terminals, a move led by the Australian Payments Network (AusPayNet)[1].

This sentiment can also be translated to the gift card space. What has traditionally been a somewhat ‘hands-on’ process — from purchasing in-store to the act of giving itself — gift cards are now turning completely digital and Indue are the first in Australia to utilise the Visa network to make this happen.

It’s a move that’s in line with shifts in consumer behaviour. A 2019 survey by Roy Morgan of more than 50,000 consumers revealed 72 per cent of Australians are embracing digital payment solutions and mobile payment wallets in lieu of more traditional physical payment methods while shopping[2], and this has only been amplified as we tackle the global pandemic.

New Contactless Gift Card

Indue Chief Commercial Officer Dave Hemingway said Indue’s new contactless digital gift card offering further embeds the business’ payment expertise in the retail sector, setting a new benchmark in retail technology.

“Consumers expect fast, convenient and secure payments, and Indue is proud to redefine the boundaries to create an exciting, new product that we’re certain will benefit retailers and consumers across the country, even more so from a COVID-safe perspective,” Dave said.

“Building on our 20-year partnership with Visa, together we’ve created an entirely new product allowing major retailers to utilise a digital gift card that is universally accepted without requiring point-of-sale integration, paving the way for future advancements in this sector.”

With the widespread impacts of COVID-19 affecting several industries across the country, technology will play a key role in helping businesses bounce back. There has never been a more crucial time for retailers in particular to consider digital gift cards as a way to secure a solid consumer base and boost sales through a convenient, safe and seamless purchase journey.

In this increasingly contactless environment, the rise of innovative, digital solutions that not only streamline gift giving and receiving, but protect our overall health, will no doubt become a necessity as we continue to navigate the ‘new normal’.

Find out more about Indue’s innovative gift card offering here, or contact us today.

References

[1] https://www.auspaynet.com.au/insights/Media-Release/ContactlessLimitsCOVID-19

[2] https://www.finder.com.au/australians-digital-payments-roy-morgan-survey#:~:text=A%20new%20survey%20from%20Roy,Zip%20and%20mobile%20payment%20wallets.&text=Bill%20payment%20services%20were%20the,in%20the%20past%2012%20months.

Digital gift card convenience | A new way to give

A new digital way to give

Contactless convenience is the ultimate win for consumers when it comes to Indue’s new digital gift card offering.

Innovation in the Australian Gift Card Market