Insights

News, Events & illumin8 in Action

News

Derek Weatherley completes his 9th Vinnies CEO Sleepout

Indue’s CEO, Derek Weatherley, braved the chilly Sydney night to participate in the Vinnies CEO Sleepout. This annual event raises awareness and funds for the St. Vincent de Paul Society, a charity dedicated to combating homelessness in Australia.

Derek’s commitment to this cause is unwavering, having taken part in the Sleepout for nine consecutive years. Through his efforts, he has raised over $100,000 for Vinnies, with this year’s contribution alone totaling an impressive $14,000—surpassing his target.

Thanks to the continuous support from Indue’s community, Derek’s fundraising efforts have had a significant impact on the lives of many. Vinnies uses these funds to provide essential services like food, accommodation, and support programs, offering hope and a path forward for those experiencing homelessness.

The Vinnies CEO Sleepout is more than just a fundraising event; it’s a powerful reminder of the challenges faced by those without shelter. By spending a night on concrete and cardboard, Derek and other participants gain a deeper understanding of the harsh realities of homelessness.

Indue is proud of Derek’s ongoing dedication and thanks everyone who has supported the Sleepout these past 9 years and supports our Indue Values of Real Heart. Real Action.

AP+ 2025 Roadmap

30 January 2025

Following the release of our inaugural product roadmap in 2024, we are pleased to publish our updated 2025 roadmap that combines our product and infrastructure priorities. The 2025 AP+ Roadmap outlines key industry and regulatory requirements alongside other major initiatives.

Key updates include:

- Click to Pay for eftpos

- Consolidated developer portal and consolidated member portal

- NPP multi-credit transfer solution design

- NPP process and message usage uplift

Along with the above changes we are confirming December 2026 as the delivery date to upgrade the ISO 20022 version that the NPP operates on.

Exploratory work also continues, and any successful developments will be included in future roadmap updates.

We will continue to engage with the industry and our members as we progress, and updated versions of the AP+ roadmap will be published annually.

The 2025 AP+ Roadmap outlines key industry and regulatory requirements alongside other major initiatives.

Move to NPP: to prepare for the decommissioning of BECS in 2030, we are focusing on ensuring the NPP has the capability, capacity, reach and resilience to easily manage the expected volume of direct entry payments. This work includes:

- NPP process & message usage uplift: developing an approach for the return of bulk payments processed through the NPP; introducing batch identifiers to support the grouping of transactions; introducing a standard payment instruction format that end users can provide to their financial institution; and uplifting PayTo message usage (Merchant Category Codes, Ultimate Creditor) to support improved fraud screening.

- NPP ISO version upgrade: upgrading the ISO20022 version that the NPP operates on to enable software integrations by international vendors and benefit from innovations adopted in other markets.

- NPP Multi Credit Transfer solution: AP+ will begin detailed design work with industry in 2025 to support high-volume bulk payments with multiple transactions contained within a single message.

- NPP cloud migration: this will allow directly connected participating organisations to integrate their back office with the NPP platform infrastructure via public cloud providers.

- NPP capacity upgrades: ensuring that processing capacity is uplifted across the platform and participating organisations.

Mobile Least Cost Routing (LCR) implementation: the industry is expected to support mobile LCR by the end of 2024.

QR acceptance: our goal is to enable initiation for in-store payments using any smart device, initially via QR. It aims to provide consumers with a greater variety of services at the point of sale and integrate other experiences such as loyalty programs or simplified integrated initiation.

eftpos – token cryptogram: introducing a token cryptogram for cardholder-initiated transactions to enhance the security and efficiency of the Australian payment ecosystem, while fostering customer trust, and compliance with evolving industry standards.

Confirmation of Payee (CoP): a layer of protection for payments to a BSB and account number in Australia. By matching the account name, BSB and account number entered with the details held by the recipient’s bank, Confirmation of Payee gives more confidence that payments are going to the right account.

eftpos – Click to Pay implementation: AP+ is standing up a Click to Pay service with the ambition to streamline e-commerce checkout and make it consistent, convenient and secure.

NPP PayTo porting: allow consumers to move PayTo agreements between financial institutions without having to contact each merchant and re-authorise their PayTo agreements. This will reduce the impact on merchants when their customers change banks.

Osko / SCT harmonisation: brings together the BPAY OSKO service with the native Single Credit Transfer (SCT) NPP product to simplify real-time payments into a single service, with a single brand and clear value proposition, streamlined rules and associated operational processes.

eftpos to update to 3DS 2.3: AP+ plans to support 3DS 2.3 to help reduce cart abandonment rates and provide enhanced risk management.

3DES migration to AES: Australian card payments will be migrated from 3DES to a new encryption standard (AES) by 2030.

Portal consolidation: AP+ is consolidating the developer experience across our products into a singe developer portal. We are also creating a single front door for members with a unified and streamlined member portal.

Cyber security capability uplift, fraud capability uplift and trust layer: AP+ is uplifting its maturity in the foundational cyber capabilities required to govern, identify, protect, detect, respond and recover from cyber incidents. AP+ is also expanding fraud capability across each AP+ scheme and supporting industry fraud and scam initiatives.

Australian Consumer Spending Holds onto Gains, Starts 2025 in Expansion Territory

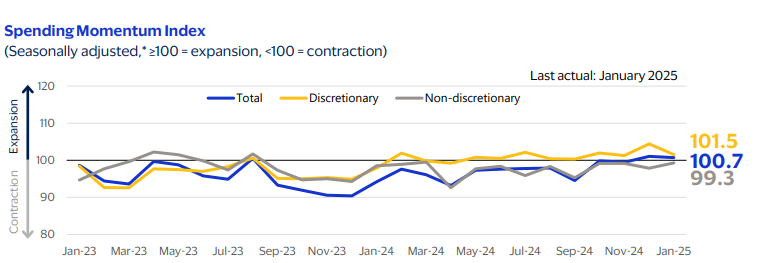

After a weak year overall for Australian consumer spending, Visa’s Australia Spending Momentum Index (SMI) remained in expansion territory at 100.7 in January. The reading’s relative consistency with the previous month, which included strong holiday sales, bodes well for a sustained recovery. Spending momentum improved in all states and territories except for the Australian Capital Territory. While Victoria and Queensland were the only two states with readings below 100, their first readings for 2025 were above their 2024 averages and are on track to hit the 100 mark. Following the holiday shopping season, the discretionary SMI fell 2.9 points to a still-solid 101.5 in January. The index stayed above 100 for the ninth consecutive month, indicating strength in spending momentum on non-essentials, such as travel. The index for all states and territories remained at healthy levels, with Queensland having the strongest reading. At the same time, restaurant spending momentum saw a decline, led by the Northern Territory and South Australia. By contrast, the non-discretionary index inched up 1.4 points to 99.3, with the strongest improvement in two states that experienced weak consumer spending in 2024: Tasmania and South Australia. With inflation slowing, consumer spending is expected to be resilient, with geopolitics and the pace of interest rate cuts two major risk factors to watch.

Spending Momentum Index (Seasonally adjusted,* ≥100 = expansion, <100 = contraction), last actual: January 2025

Download the Complete Report

*The discretionary and non-discretionary categories exclude restaurant and gas spending; both restaurant and gas are included in the total SMI. See additional definitions of spending categories on page 3 of the attached report.

Source: Visa Business and Economic Insights. The Visa Australia SMI measures the current month relative to the same month last year. The national readings of the index are based on year-over-year changes in consumer spending with Visa bankcards.

Protecting your digital identity

During this Scams Awareness Week, we’re sharing our top tips to combat scams. Following on from Safeguarding older and vulnerable individuals from scams today we bring you the next tip in our series.

Tip 2: Protect your data like you protect your wallet!

Financial institutions spare no effort in combating fraud and protecting their customers from scammers, and there are thousands of people working around the clock to protect you and your money.

However, in recent years scammers have realised they are competing with advanced multimillion-dollar fraud detection controls and systems, and therefore the path of least resistance is to trick customers into helping them bypass the fraud controls that are put in place for customer protection.

The truths we must acknowledge:

1. Scammers already have some of your data

There’s an alarming amount of compromised data out there, and scammers are becoming increasingly skilled at exploiting it. The numerous Australian data breaches publicised widely are just the tip of the iceberg.

You can check how many data breaches have involved your details at this website: https://haveibeenpwned.com/

2. If you think you are too smart to be scammed, you are a great target!

Scammers, armed with your stolen data, can piece together a comprehensive profile of their targets. That seemingly innocent chat on WhatsApp or a transaction on Facebook Marketplace can be a data-mining expedition. This, in turn, can be exploited to build trust and manipulate people into compliance.

The following are some steps you can take to shield yourself from scams:

- Stay informed: Learn from the experiences of scam victims, by putting yourself in the victim’s situation and considering how the controls you have in place could have protected you in their situation.

- Limit personal information sharing: Be cautious about the amount of personal information you share on social media ,and tighten your security settings. The less scammers know about you, the harder it is for them to craft convincing scams.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA for your online accounts. This adds an extra layer of security, making it significantly more difficult for scammers to gain access to your accounts.

- Have strong, unique passwords: Don’t underestimate the importance of strong, unique passwords for each of your online accounts. Consider using a reputable password manager to help you generate and store them securely.

Your data is your digital identity, and safeguarding it is vital. Scammers can use your data to gain trust, manipulate, and exploit vulnerabilities.

By taking steps to protect your data and sharing this knowledge with others, we can collectively defend against data-driven scams and build a safer digital world.

Safeguarding older and vulnerable individuals from scams

Australians have lost $430 million to scams already in 2023, and as Christmas approaches, we can expect another spike in scam activities.

Here’s our top tips to combat scams.

Tip 1: Safeguarding older and vulnerable individuals

Equipping ourselves and our loved ones with the knowledge needed to fend off scams is crucial.

In this digital age, scams can affect anyone, regardless of age or technological know-how. However, older, and more vulnerable individuals tend to fall prey to scams more often.

In 2023, Australians over 65 have lost more than $108 million to scams and represented one in four of all scam reports.

To combat scams effectively, it’s important to educate those at higher risk of becoming a victim. Sharing our knowledge, experiences, and staying vigilant empowers them to recognise and respond to potential threats.

Here are a few suggestions on how we can play a vital role in protecting our loved ones:

Initiate conversations

Be a trusted, non-judgmental resource available at any hour of the day. Engage in open discussions with older family members, friends, and acquaintances about the potential dangers lurking online. Encourage them to ask questions and share their concerns.

Teach them to identify red flags

Educate older individuals about common scam warning signs such as unsolicited calls, suspicious emails, requests for personal information, or high-pressure sales tactics. Equipping them with this knowledge improves their confidence in navigating scam scenarios.

Encourage scepticism

Encourage healthy scepticism and a “trust but verify” approach when encountering unknown or unfamiliar entities. Remind them to independently verify the legitimacy of offers, requests, or investments before committing to any action.

If it doesn’t feel right, JUST HANG UP!

Phone scams result in more monetary loss than any other method. If someone on the phone is making them uncomfortable or is moving too fast, they can always hang up! Scammers feed on people’s politeness. It’s better to risk offending someone than to risk a scammer taking all of your hard-earned money.

We encourage you to share with your vulnerable loved ones so that we can all be protected.

Let’s work together to ensure we’re all protected from the harms of scams. By extending our helping hands, we can make a significant impact in their lives and collectively build a stronger and safer community.

For additional information on supporting scam victims, visit the Scamwatch website: https://www.scamwatch.gov.au/protect-yourself/help-someone-whos-being-scammed

Read more scam-busting tips:

Events

Step Inside the Minds of Global Payment Leaders at the Indue Summit 2025

The way we pay isn’t just changing, it’s evolving at a pace few industries can match. From AI-driven fraud detection to centralised data ecosystems, the payments world is on the move and keeping up means knowing what’s next.

We are bringing together some of the world’s leading payment powerhouses at the Indue Summit 2025 to share emerging trends, the latest insights and real-world guidance to help drive innovation and excellence in your organisation.

Visionaries, strategists and leaders from across the payments ecosystem will take the stage to unpack every step of the payments experience, from security and speed to transparency and trust.

These leaders aren’t just talking about what’s next – they’re shaping it.

JOE GARNER – Experienced CEO and Business Leader, UK

Curious about what’s happening in the global payment arena?

Joe Garner will take the stage to share insights from his work authoring the 2024 Future of Payments Review UK – an independent government-commissioned report with recommendations to drive innovation, accessibility and security across the UK’s payments ecosystem.

With a career spanning senior roles at Nationwide Building Society, HSBC UK, Procter & Gamble and Openreach, Joe Garner is no stranger to navigation disruption – from Brexit to the pandemic – and will unpack the key global trends and decipher what they mean for Australian businesses.

BOB HEDGES – Former Chief Data Officer, Visa

In a new digital age, it’s no secret data and AI are changing expectations regarding how we do business.

At the Indue Summit 2025, Bob Hedges, now serving as Senior Advisor for Data at Visa, will frame the new success requirements for navigating this evolving landscape to earn trust, embrace technology and build partnerships in an increasingly digital world.

With a data-first perspective, he’ll demonstrate how AI and analytics don’t require you to be a tech expert to unleash their potential for your business.

Drawing on decades of global experience leading data strategy at Visa and other major institutions, Bob Hedges brings a bold, consumer-focused, vision for the future of payments and commerce in an AI-powered world.

ANDY WHITE – CEO AusPayNet

LUKE WILSON – COO AusPayNet

As key leaders of Australia’s self-regulatory body overseeing payment systems, Andy White and Luke Wilson are helping shape the secure, modern and resilient infrastructure that underpins how Australians pay.

Andy White will lead a panel on the fight against financial crime to explore regulatory priorities, reveal emerging threats and underline the importance of a coordinated industry-wide response to scams.

Luke Wilson will co-present a session exploring the shift toward a modern payment system, offering insights into what the future holds, the industry’s role in driving progress and how this transformation will reshape the payments landscape.

INDUE SUMMIT 2025

And this is just the beginning. The guru line-up continues with more thought leaders across business, technology, mindset and customer experience, including:

- John Bertrand AO – International Yachtsman, Businessman and Philanthropist

- Simon Kuestenmacher – Director and Co-founder, The Demographics Group

- Luci Ellis – Chief Economist, Westpac Banking Group

- Stephanie Elliot – COO, COBA

- Sarah Court – Deputy Chair, ASIC

- Catriona Lowe – Deputy Chair, ACCC

- Katrina Stuart – Executive Sponsor, Move to NPP, Australian Payments Plus

- Chris Riddell – Human Futurist, Forensic Optimist and Energising Catalyst

The Indue Summit will be held on Thursday 15 May at the Intercontinental Sydney, a day full of big ideas and big names.

Don’t miss this unique opportunity to engage in transformative discussions, network with peers, and walk away with the insights to propel your business towards tomorrow.

Find out more and register here: Indue Summit 2025

Join us for the Indue Summit 2025

Exciting news! The Indue Summit is coming to Sydney on May 15, 2025. Early Bird tickets are now on sale for a limited time. Don’t miss out on this must-attend payments leadership event.

The Indue Summit is an immersive event designed to provide you with the knowledge and insights needed to excel in the fast-changing world of payments.

Prepare to be inspired by exceptional leaders from Australia, the UK, and the USA who will share their strategies to drive innovation and excellence in your organisation.

This is your chance to dive deep into the dynamic world of payments and connect with the trailblazers and visionaries shaping the future.

Don’t miss out on this unique opportunity to engage in transformative discussions, network with peers, and leave with actionable insights to propel your business Towards Tomorrow.

2025 Speakers

KPMG 2024 Mutuals Industry Review webinar

As part of Indue’s Leadership Series: Cultiv8, we were pleased to host a webinar exclusively for Indue customers to present key findings from KPMG’s 2024 Mutuals Industry Review.

KPMG’s 2024 report provides commentary and insight on the mutual banking industry, based on an analysis of the financial results and key responses to our qualitative survey of Australian building societies, mutual banks and credit unions authorised by APRA (together, the Mutual sector).

In 2024, Australian Mutuals experienced continued growth in net assets and operating profits, improving their financial health. Higher net interest margins and consistent loan growth played an important role in this success, despite a deterioration in the cost-to-income ratio for the sector.

Despite the successes, customer-owned banks need to find a way to balance their support for communities during the current cost-of-living crisis with cost reduction, service expansion, process uplift and threat protection. But, the era of AI and advanced technology is here, and can help transform strategy and operations. Dive into our report for more insights, with special focus on digital transformation, AI, cyber security, ESG and trust and regulation.

RFI Youth Banking Study Webinar

As part of the Indue Leadership series – Cultiv8, we’re proud to invite you to this exclusive customer event in partnership with RFI Global.

The Youth Banking Study promises to deliver unique insights on topics related to youth banking, finances and payments, including (but not limited to) financial literacy, banking relationships, payments, the role of parents and other influences and attitudes towards new technologies and providers.

Program

- Indue Welcome & Overview

- RFI Research Methodology

- View from parents on financial education and banking

- Youth banking:

> Sentiment towards finance and banking

> Banking relationships, decisions and drivers

- Questions & Discussion

EVENT DETAILS

EVENT NOW CLOSED

*This event is for customers of Indue only. Anyone registering who is not a customer of Indue will have their name and organisation shared with RFI.

Indue AML Forum 2024

As part of the Indue Leadership series – Cultiv8, we’re proud to invite you to this exclusive customer event presented by KordaMentha and ICMEC Australia.

Operating within the payments industry comes with an obligation to minimise the opportunity for payment systems to be misused. This is driven by regulatory compliance, a desire to minimise losses for our clients and our own corporate values around social responsibility.

All the while, others will continue to find new ways to exploit payments products and services.

This session has been developed to provide Insights into creating an organisation wide approach to Child Sexual Exploitation, for the betterment of our communities and compliance with AML/CTF obligations.

Program

- Indue Welcome & Overview

- Rosie Campo, Head of Collaboration at the International Centre for Missing & Exploited Children Australia will talk about the importance of understanding the prevalence of child sexual exploitation (CSE) and how financial services can be part of the solution to fighting this heinous crime.

- Grace Mason, Executive Director, Financial Crime at KordaMentha will share her expertise across the private and public sectors to understand the risks of CSE to your organisation, domestically and across the Asia – Pacific region.

- Questions & Discussion

EVENT NOW CLOSED – Please register your details for upcoming events

Regulation, challenges, innovation: Inside AusPayNet Summit 2023

The Indue team was excited to sponsor and attend last week’s AusPayNet Summit, an annual end-of-year highlight for the payments sector, bringing together industry experts, decision-makers, innovators, and regulators for stimulating discussions on the future of payments in Australia.

The theme of this year’s AusPayNet Summit 2023 ‘A Turning Point’ – focused on how the industry can take advantage of current opportunities to deliver secure and customer-focused payments systems, within a sector focused on encouraging innovation and fostering collaboration.

As leaders in payment services, the Indue team valued the opportunity to connect with others in the industry, explore emerging trends, share valuable insights and collaborate on solutions for challenges facing our industry.

Our key takeaways included:

- Industry, government and the RBA need to work together to modernise the rapidly evolving payment services sector.

- Licensing of payment providers must balance risk mitigation with seamless access.

- Reforms of the cheque system are underway but will take substantial time and effort to complete.

- Appropriate regulation of open wallets is needed given their increasing role in the payment’s ecosystem.

- AI can provide enhanced decision making and improved efficiency, but it isn’t always the best solution.

RBA Governor insights on payments modernisation

The Summit included a fascinating address by the newly appointed Governor of the Reserve Bank of Australia, Michele Bullock, who spoke about how the Government’s reforms to modernise the payments system will enhance safety, efficiency and competitiveness across the payments ecosystem.

The key takeout from the Governor’s address was that industry, government and the RBA will need to work together on navigating the broad range of key challenges in the rapidly evolving payment services sector.

The three key issues that will be particularly strategically important to the RBA in 2024 include: 1) the next review of retail payments regulation (which will include a focus on Least-cost routing (LCR), Mobile wallets, and Buy-now-pay-later (BNPL) services); 2) maintaining access to cash; and 3) supporting the transition from BECS to modern payment systems.

Governor Bullock noted some significant challenges will need to be overcome for the industry to successfully transition all BECS payments to more modern payment systems, including financial institutions needing to uplift their processing capacity, and enabling NPP services that can reliably handle the full range of payments that are currently processed by BECS.

A balanced approach to crucial reforms

With Australia’s payment landscape evolving at such a rapid pace, Summit discussions shed light on the crucial reforms aimed at reshaping the sector’s regulatory architecture.

Discussions about the licensing of payment providers revolved around finding a balance between safeguarding against potential risks and ensuring seamless access for users, which is pivotal for the sustained growth of the payment services sector.

As this year’s AusPayNet Summit reinforced, collaboration among industry leaders, regulators, and all stakeholders will be critical in developing a regulatory landscape that caters to the ever-evolving needs of the payment ecosystem.

Regulating new ways to pay

The shift from traditional cheque-based transactions towards digital methods has been led by customers and while the system is ready for change, a full transition and phase-out of cheques will require significant time, and substantial efforts in revamping systems and processes. It will also require overcoming barriers such as a lack of digital capabilities or distrust of digital solutions among consumers.

The regulation of open wallets is also increasingly necessary given the substantial role they play in the payment’s ecosystem. There is a need for appropriate regulation that aligns with the evolving nature of wallet providers.

Threats and opportunities of AI

Generative AI does provide a revolutionary new tool with the potential to fundamentally change the way things are done, with opportunities to significantly improve decision making, personalisation and the efficiencies of payments technology.

However, when considering security in payments, AI isn’t always the best solution. There is a need to consider how the use of AI impacts the threat landscape, as well as questions around ethics, equity and responsibility of data.

On Demand

KPMG 2024 Mutuals Industry Review webinar

As part of Indue’s Leadership Series: Cultiv8, we were pleased to host a webinar exclusively for Indue customers to present key findings from KPMG’s 2024 Mutuals Industry Review.

KPMG’s 2024 report provides commentary and insight on the mutual banking industry, based on an analysis of the financial results and key responses to our qualitative survey of Australian building societies, mutual banks and credit unions authorised by APRA (together, the Mutual sector).

In 2024, Australian Mutuals experienced continued growth in net assets and operating profits, improving their financial health. Higher net interest margins and consistent loan growth played an important role in this success, despite a deterioration in the cost-to-income ratio for the sector.

Despite the successes, customer-owned banks need to find a way to balance their support for communities during the current cost-of-living crisis with cost reduction, service expansion, process uplift and threat protection. But, the era of AI and advanced technology is here, and can help transform strategy and operations. Dive into our report for more insights, with special focus on digital transformation, AI, cyber security, ESG and trust and regulation.

RFI Youth Banking Study Webinar

As part of the Indue Leadership series – Cultiv8, we’re proud to invite you to this exclusive customer event in partnership with RFI Global.

The Youth Banking Study promises to deliver unique insights on topics related to youth banking, finances and payments, including (but not limited to) financial literacy, banking relationships, payments, the role of parents and other influences and attitudes towards new technologies and providers.

Program

- Indue Welcome & Overview

- RFI Research Methodology

- View from parents on financial education and banking

- Youth banking:

> Sentiment towards finance and banking

> Banking relationships, decisions and drivers

- Questions & Discussion

EVENT DETAILS

EVENT NOW CLOSED

*This event is for customers of Indue only. Anyone registering who is not a customer of Indue will have their name and organisation shared with RFI.

Indue AML Forum 2024

As part of the Indue Leadership series – Cultiv8, we’re proud to invite you to this exclusive customer event presented by KordaMentha and ICMEC Australia.

Operating within the payments industry comes with an obligation to minimise the opportunity for payment systems to be misused. This is driven by regulatory compliance, a desire to minimise losses for our clients and our own corporate values around social responsibility.

All the while, others will continue to find new ways to exploit payments products and services.

This session has been developed to provide Insights into creating an organisation wide approach to Child Sexual Exploitation, for the betterment of our communities and compliance with AML/CTF obligations.

Program

- Indue Welcome & Overview

- Rosie Campo, Head of Collaboration at the International Centre for Missing & Exploited Children Australia will talk about the importance of understanding the prevalence of child sexual exploitation (CSE) and how financial services can be part of the solution to fighting this heinous crime.

- Grace Mason, Executive Director, Financial Crime at KordaMentha will share her expertise across the private and public sectors to understand the risks of CSE to your organisation, domestically and across the Asia – Pacific region.

- Questions & Discussion

EVENT NOW CLOSED – Please register your details for upcoming events

KPMG 2023 Mutuals Industry Review webinar

As part of Indue’s Leadership Series: Cultiv8, we were pleased to host a webinar exclusively for Indue customers to present key findings from KPMG’s 2023 Mutuals Industry Review.

KPMG’s 2023 report provides commentary and insight on the mutual banking industry, based on an analysis of the financial results and key responses to our qualitative survey of Australian building societies, mutual banks and credit unions authorised by APRA (together, the Mutual sector).

The last 3 years have seen unprecedented disruption for the mutual banking industry in Australia to navigate, from the impacts of Covid in 2020 and 2021 to climate-weather events in 2022. Challenges for customer-owned banking institutions continued into 2023 with softening economic conditions, high inflation levels contributing to further interest rate increases and the cost-of-living pressure continuing to have an impact on their customers.

Economic uncertainty both globally and nationally continues to put financial pressure on local communities. Supporting these communities is a core purpose for the mutual banking sector as unlike investor-owned banks, the profit of customer-owned banks are not paid to shareholders but reinvested to meet their customers’ banking needs.

Notwithstanding this, the mutual banking sector operates within the broader banking ecosystem which provides multiple challenges for a purposeful future.

illumin8 in Action

Dnister & Indue Long Term Partnership

Pictured above: Andrew James (Dnister, CEO ), Derek Weatherley (Indue, CEO), Solomiia Vozniak (Dnister, Personal Banker), Frank Gullone (Indue, Chair), Bohdan Wojewidka (Dnister Board Chair).

This was a special week for the Indue Team as we welcomed our long term partners, Dnister to our offices. The partnership we have with Dnister is 32 years young and has been particularly special in recent years due to us working closely together to assist people who have been displaced as a result of regional conflict and found themselves in Australia with nothing but the clothes on their back.

Our staff were honoured to hear directly the powerful story of Solomiia, a refugee who connected with Dnister upon arrival in Australia. After initially being supported by Dnister, Solomiia went on to be employed by Dnister and worked tirelessly to support many other refugees through a range of support programs. These included the basic necessities of life, through to support groups, all the way through to assistance with financing new businesses to establish livelihoods in Australia. Indue was pleased to partner with Dnister on one of these programs, through our own community support program, Illumin8.

Indue was honoured to receive a Motanka doll as a token of thanks. The Motanka doll is of particular cultural significance in the Ukraine and represents courage, bravery and friendship. The doll holds a small piece of amber in its hands to remind us to always hold on to the sunshine through the difficult journeys in life.

The story was a bright illustration of the difference between a community bank and a commercial bank and the impact that mutuals can have on making a better society.

Thank you to Dnister for your partnership and for your outstanding work in bettering our society.

COBA 2023 Presentation

Take the time to have a listen to the Dnister story and presentation shown at the 2023 COBA conference. Solomiia Vozniak spoke to Key Leaders of the finance industry in Australia about her journey as a displaced person and the role Dnister and the community plays in support of those who recently arrived.

Vinnies CEO Sleepout 2024

Real Heart. Real Action. This year our CEO, Derek Weatherley spent the night in the Hunter region to support the excellent work of Vinnies and the Vinnies CEO Sleepout . Derek has been participating in this initiative for 8 years and said “I’m grateful to have had the opportunity to spend some time in the Hunter this year hearing about the extent of the local homelessness issues in that region and the wide range of programs that Vinnies undertake to support people into secure and sustained housing arrangements. I also had the opportunity to spend some time with Mark Williams the CEO at The Mutual Bank who are always looking at ways to support the greater Hunter community.” hashtag

Thank you to the many of you associated with Indue that have regularly supported Vinnies through our support for the Sleepout since 2017. Vinnies do an outstanding job and your support does make a difference to the lives of those affected by homelessness

Previous

Next

illumin8 in Action – Tour de Rocks

We are proud to celebrate our Indue Director and General Manager of Coastline Credit Union Peter Townsend for successfully completing the challenging Tour de Rocks a 3 day bike ride stretching 190kms from Armadale up to Guyra and back down again. Peter undertook this amazing journey in support of Tour de Rocks who raise money for cancer research.

Not only did Peter conquer hilly terrains, but his team also managed to raise an incredible $50,000 to aid this remarkable cause!

Tour de Rocks’ mission is to engage and inspire communities to raise awareness in relation to cancer prevention through healthy living, assist those battling the disease and raise funds for cancer research.

Join us in congratulating Peter and showing our appreciation for all the hard work and effort he put into this incredible fundraising effort. Indue were proud to be able to sponsor Peter for this incredible challenge.

Read more illumin8 in action stories

Proud Silver Sponsors at COBA 2023

We’re proud to announce our silver sponsorship of COBA 2023, customer-owned banking’s leading annual event on the Gold Coast. COBA delivers engaging keynotes, interactive panel discussions, and hands-on workshops, focused on driving growth and innovation.

Head to: www.coba2023.com.au to register today and come and visit our stand ‘Silver 3’ while you’re there!

Salvos Volunteering

30 August, 2023

Well done to the 6 Sydney and 4 Brisbane team members who hit the Salvos Warehouse at their Tempe and Red Hill locations to volunteer their time to give back to this great organisation. From price tagging books and clothing items, to the big job of Alphabetising the large selection of novels, the team were busy in the warehouse and on the floor – one was so comfortable in his volunteer role that he was mistaken for Staff and asked about the furniture for sale.

The Salvos’ Floor Manager was most impressed with the work the team did in organising the bookshelves – the team compared their respective step count at the end and it was very impressive as they raced from A through Z of what would have been over 10 000 books.

illumin8 in action

We are proud to celebrate our Head of Architecture, Keith Bromwich, for successfully completing the challenging 6-day Jatbula Trail in Northern Territory! What’s even more amazing is that Keith undertook this incredible journey in support of Careflight, an incredible non-profit organization dedicated to saving lives with their critical care aeromedical services all over Australia.

Not only did Keith conquer mountains and brave rough terrains, but he also managed to raise an outstanding $9000 to aid this remarkable cause! This money will go a long way in ensuring that Careflight can continue to make a difference in countless lives, providing much-needed help when it’s needed the most.

Careflight’s dedication to providing urgent medical assistance is truly inspiring, and we are proud to be part of their mission. With every dollar raised, we contribute to their ability to bring hope and support to those in desperate need.

Join us in congratulating Keith and showing our appreciation for all the hard work and effort he put into this incredible fundraising trek. Together, we can make a difference and support organizations like Careflight that selflessly serve our communities.