Insight: The changing face of consumer payments in Australia

Insight: The changing face of consumer payments in Australia

Our guest writer, David Oierholm, Director of The Initiatives Group, sheds light on the changes and trends of consumer payments in Australia.

The ways in which consumer payments in Australia are made is often likened to a train system comprised of the “rails” that carry the carriages (the payment systems), and the “carriages” that carry the passengers (the individual payments).

The media will have us believe that the payments landscape in Australia is constantly and rapidly changing. To an extent this is correct – but this is all about new “carriages” rather than “rails”.

Furthermore, simply because there are new ways to pay on offer, it does not mean that we all immediately change the way we pay. For example, it took well over 5 years for both BPAY and (much later) contactless card payments to become mainstream.

In Australia, there has only been one new set of rails introduced in the past 25 years (The New Payments Platform (NPP), 2018)

The Way We Pay

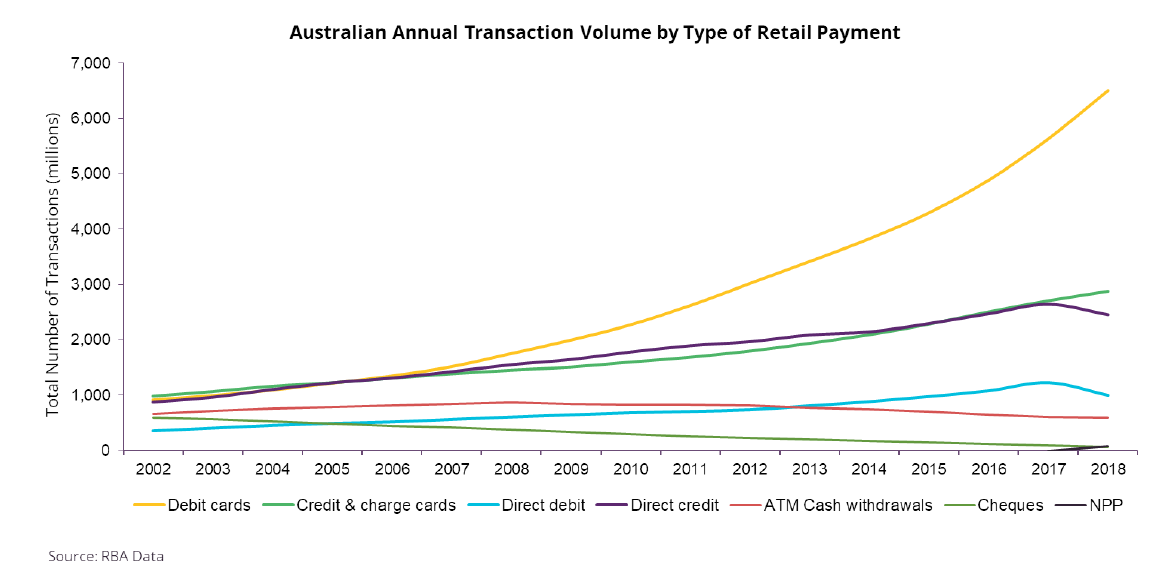

It is about trends, and long-term ones at that. The following graph shows how the ways we pay (our use of the rails) have changed over the past 16 years, exhibiting slow movements and not, as many media commentators would suggest, overnight leaps.

The trends are clear – cash (as proxied by ATM withdrawals) and cheque usage are on the decline, and fast becoming the minority of transactions. Electronic payments continue to increase. Cards now account for more than 50% of all payment transactions, with the growth in debit card activity far outstripping credit card since 2007. It is now quite normal to pay for a morning coffee using a card – not so long ago a $3.50 purchase would have been made with cash.

Will cash and cheques ever completely disappear? It is more likely that cheques will disappear, but only when the industry and/or regulator set a termination date – otherwise someone, somewhere will keep using them. However, the ability to access and use cash is considered critical for members of society who may be unbanked, and for remote residents where electronic payments may either be unavailable or inconsistent. Even in those economies closest to being cashless, such as Sweden, there are government requirements for the economy not to become cashless – at least not until no one is left behind or disenfranchised.

In 2019, the San Francisco Board of Supervisors passed a law requiring that all bricks and mortar retail businesses must accept cash – this even includes the Amazon Go stores (more about them later). This move is to make sure that the city’s poorest residents are not shut out of access to basic goods and services. Whereas “cash not accepted” signs are common in shops in Sweden.

The Rails

The rails for electronic payments in Australia include the card rails (Visa, Mastercard, Amex, eftpos), the rails for direct entry and direct debit payments known as BECS (Bulk Electronic Payment System), the real-time payments rails operated by New Payment Platform Australia (NPP) and the international bank to bank transfer rails (SWIFT). The only one of these sets of rails that has been introduced within the last 25 years is the NPP, launched last year.

(Source: The Initiatives Group)

The Carriages

What runs on the rails is where the new action has been, as a plethora of “veneers” have been placed on top of the payment rails, giving the perception that the movement of money has changed. What has changed, and greatly, is the consumer interface, which has become more convenient, simple to use, frictionless and seamless. But, as noted earlier, just because a new way to pay is being offered there is no guarantee that it will be used.

Mobile Wallets (Mobile Payments)

Mobile wallets such as Apple Pay, Google Pay and Samsung Pay, otherwise known as “The Pays”, have arguably received more media headlines than any other payments related topic over the past few years. Despite this, it is estimated that they represent fewer than 5% of card present transactions, albeit that there now seems to be some acceleration in the adoption rate.

Requiring a credit or debit card to fund a transaction, The Pays operate on the Visa, Mastercard, American Express and, to a lesser extent, the eftpos rails. They have been offered in Australia since 2015 when Apple Pay was launched with Amex.

Even though some would describe it as simply a new “form factor” – a contactless payment (now over 90% of card present transactions) using a phone rather than a plastic card – the rollout through the payments industry has been slow. A popular hypothesis is that using your phone currently offers little benefit over using a plastic card – that is, there is no value added.

In addition, there has been significant reticence amongst the major banks to fund the fees payable to Apple Pay, which also comes with the limitation of no other application being able to access the NFC interface on the iPhone. However, as of today the only major Australian bank that does not offer Apple Pay (considered the vanguard of The Pays) is Westpac, so it is felt that the current low usage rates will increase to more significant levels over the next few years, assisted by use on mass transit.

A different type of mobile wallet where you can “pre-fund” your account prior to purchase (or link to a “top up” source of funds) is particularly popular in China, and increasingly so throughout Asia. AliPay and WeChat Pay both from China are prime examples.

When making purchases, these systems run on their own sets of rails with the transaction driven by a QR code interface (overcoming Apple’s NFC quarantine). This has permitted significant growth in electronic payment acceptance due to the simple and low cost set up for the payee. However, to fund the account, money is transferred from the user’s card or bank account.

This means the funding uses existing payment rails. To date the use of QR codes in payments in Australia has primarily been limited to visiting Chinese tourists. Australians are already well served by NFC contactless payments, so, whilst there may be more value-adding capability within a QR code, there is little incentive for consumers to change.

Another popular wallet, although not so much in mobile format (at least not in Australia), is PayPal. Created as a payment wallet to make secure online transactions, the PayPal wallet can be instantly funded by a credit or debit account, or pre-funded. An interesting contrast is that in the US keeping funds in a PayPal wallet is popular, whereas in Australia it is not.

In-app Payments or “payments in the background”

Popularised by the success of the Uber rideshare app and the “just get out of the car at your destination and walk away” payment experience, in-app payments are the topic of a separate whitepaper published by The Initiatives Group.

Sometimes criticised for making it too easy for consumers to overspend as they do not have a “transaction moment” to reconsider their purchase, in-app payments are growing even faster than e-commerce. Prime examples include Uber – familiar to most of us; Grab, which dominates carshare in South East Asia, and which is now promoting its payment service in its own right as “GrabPay”; and the Hey You (Beat the Q) café pre-order and payment aggregator app.

In the USA, Starbucks is prolific enough to have its own pre-order and payment app, which accounts for a significant proportion of their sales and is integrated with the Starbucks Loyalty program. Further loyalty integrations are underway. For example, in the USA you can use American Express Membership Rewards points to pay for your Uber ride. Amazon is taking the in-app, seamless shopping and payment experience to the nth degree, (possibly out of the budgetary capabilities of most retailers) with its Amazon Go “no lines, no checkout” concept stores, it is extreme but an insight into what is already possible!

In Australia, Woolworths is currently trialling “Scan & Go” with selected Woolworths Rewards loyalty members in Sydney – it is a variation on Amazon Go, where shoppers scan items when they take them from the shelf and then just tap off when leaving the store. This is important, as Woolworths and Coles are able to move the market: it was really not until they adopted the NFC technology that contactless payments became commonplace in Australia.

The Form Factor

Many innovations on the existing payment rails are actually changes in the form factor. As noted earlier, mobile payments are, for the most part today, simply the ability to use your phone to make a contactless card payment, rather than use the physical card itself.

Other new form factors include smart watches, including the Apple watch, Samsung Gear watches, as well as Garmin and Fitbit with Garmin Pay and Fitbit Pay respectively. Similarly, there are wrist bands and tabs attached to watch bands, even sunglasses and jewellery, such as the Bankwest Halo Payment rings. Current opinion is that these “wearables” will become popular, but amongst niche groups rather than the general population – for example waterproof bands and rings for swimmers, surfers, runners and cyclists.

BPAY and Pay Anyone

BPAY and Pay Anyone (Direct Credit on internet banking or a banking app) are payment methods that use the BECS Direct Entry system. Both allow for bank account to bank account transfers five days a week (excluding Public Holidays), with banks transferring funds 5 times per day (but not necessarily posting them to accounts that frequently).

Reliable, secure and low cost, however it is possible that a transfer can take some time to occur or appear in the receiving account – if the transfer is made late on Friday afternoon and is to a bank that is not posting intra-day settlements it may not be until the following Tuesday that the funds appear in the recipient’s account.

Whilst BPAY volume continues to grow, BPAY now somewhat competes with itself as the provider of the first “overlay” service “Osko” for the NPP, which allows real time payments between consumers and businesses via BSB and account number or with a registered PayID (mobile number, email address or ABN) linked to their bank account. Further, a number of Financial Institutions have and are moving their Pay Anyone / Direct Credit transactions onto the NPP rails, instead of using BECS.

P2P (peer-to peer) Payments

Particularly popular in geographies as diverse as the USA and China (perhaps due to the antiquated and previously limited payment systems available), P2P payments allow instant payments between consumers – splitting the bar tab, paying your share of the rent, getting money to the kids quickly, etc.

Venmo (now owned by PayPal) in the USA and WeChat Pay in China are prime examples. Both allow instant payments between other Venmo or WeChat Pay users from a pre-funded wallet. Perhaps they could be considered alternative rails, however, funding still comes from the existing rails transfer methods as these are linked to accounts.

In Australia, BeemIt allows P2P payments between BeemIt users, requiring only a Visa or Mastercard debit card for registration. Interestingly, BeemIt accesses bank accounts by using Visa and Mastercard for the authorisation messaging, then uses the eftpos rails to achieve the instant funds transfer.

As with many new ways to pay, BeemIt has not (yet) become popular in Australia as it has yet to gain sufficient penetration or ubiquity, and perhaps does not solve a significant problem that Australian consumers have (given the various other ways that they have to pay).

Real-time Payments

The establishment of real time payments platforms, moving and posting money between accounts 24×7, such as Australia’s NPP, is a major global trend. The UK has had “Faster Payments” and Singapore “FAST” for some time. More recently, Malaysia “DuitNow” and TCH (“The Clearing House”) in the USA have introduced real time payment platforms.

The NPP was launched in February 2018, the first new payment rails in Australia for 25 years (the prior launch was BECS in 1993). The NPP is an initiative that was primarily driven by the Reserve Bank of Australia, following its review of innovation in payments, and is co-owned by 13 banking organisations. It allows for real time payments between bank accounts.

To date, it has been held back by a somewhat uncoordinated introduction through the banking system. Whilst over 2 million PayID’s have been registered, use of the Osko payment “overlay service” has been relatively limited. This is likely to change once all banks deliver the range of features available, more entities register PayID, and business applications such as “Request to Pay” and a central consent management platform are delivered (effectively allowing Direct Debit transactions to be introduced by the NPP).

To date, it has been held back by a somewhat uncoordinated introduction through the banking system. Whilst over 2 million PayID’s have been registered, use of the Osko payment “overlay service” has been relatively limited. This is likely to change once all banks deliver the range of features available, more entities register PayID, and business applications such as “Request to Pay” and a central consent management platform are delivered (effectively allowing Direct Debit transactions to be introduced by the NPP).

Even Sweden’s “Swish” success story has taken almost 7 years since its establishment in 2012 to reach a total of 1 billion transactions through the system.

Use cases range from instant P2P payments, to real time payment of employee wages, superannuation, even to the ability to safely buy/sell a used car privately on the weekend without the need for cash transfers or bank cheques.

(Image Source: Osko.com.au)

Real-time / Faster Cross Border Payments

Cross border account to account payments have primarily been the domain of Swift and its 165 member banks. Even if the origin or destination banks are not members, the 165 banks can act as “correspondent” banks to route funds into the recipient country and currency, then onto the recipient bank. It is reliable, but can be slow, opaque and relatively expensive. The Swift rails also enable currency transfer services such as Western Union.

Faced with the emerging faster cross border payment challengers, such as crypto currencies, Ripple, Visa B2B Connect, and Visa and Mastercard acquiring FX transfer platforms, Swift has been developing faster, lower cost transfer products to enhance its existing rails. Swift GPI (Global Payment Innovation) is now conducting faster cross border payment trials, and is poised for rollout network wide.

Swift, which also provides the distributed switching platform for Australia’s NPP, is also testing its involvement in integrating the different real-time payments platforms between countries.

Thought too slow and expensive (today) for domestic payments, cryptocurrencies and distributed ledger technology is of interest for the future of cross border payments, although there is a long way to go. For example, Bitcoin transactions can occur at between 10-20 transactions a second (versus Visa at up to 56,000 per second), and crypto currencies are infamous for the volatility of their value in fiat.

However, the announcement in June 2019 of the Libra Foundation, with its bundled currency backed blockchain based “stablecoin”, and the Facebook developed Calibra payment wallet (planned to be the first wallet for Libra transactions) has generated significant excitement and debate. Whether or not is succeeds (or even permitted to launch by regulators), it raises the possibilities of western “bigtech” finally entering the payments (and broader financial services) category, and the possibility of a truly global currency that transcends fiat currencies and national borders – at the same time, reaching one of the world’s broadest social network audiences.

Will Libra run on new rails? Within the Calibra wallet this is likely, but Libra ultimately still needs to be funded from some other electronic source such as a bank account or card (even if unbanked users pass cash across the counter at “agent” locations). Indeed, it has been suggested that, to reach merchants for POS transactions, it may use the Visa and Mastercard rails.

There will be many legislative hurdles to overcome, and, in developed countries such as Australia with highly developed payments systems, there remains the question of what real problems are Libra and Calibra really trying to solve (maybe remittances?).

Use cases range from instant P2P payments, to real time payment of employee wages, superannuation, even to the ability to safely buy/sell a used car privately on the weekend without the need for cash transfers or bank cheques.

Buy Now, Pay Later (BNPL)

With millions of customers in Australia, the USA and soon in the UK, “I’ll AfterPay it” is becoming a familiar expression. AfterPay, Zip Money, Humm and SplitIt have become particularly popular amongst millennials – Afterpay claims 69% of its users are 18-35 years old.

New way to pay, on new rails? No. Latitude and Flexigroup have been offering interest free payment plans for decades, and products such as Afterpay rely on debit and credit cards to make initial payments and subsequent repayments.

However, Afterpay and its cohort have tapped a rich vein of new business – millennials who are not migrating to credit cards, with a short-term low value instalment payment product, tuned initially for online purchases and delivered digitally. Merchants with a sufficient margin structure to absorb the 4-6% fee, see the additional sales as a boon in what is currently a tough retail environment. Add to this a group of BNPL businesses, those delivering similar products to small businesses, such as ProspaPay.

Conclusion – Consumer Payments in Australia

The adoption of electronic payments by consumers and businesses in Australia continues apace, pushing cheque and cash transactions (although not the amount of cash on issue) into a relatively steep decline. Consumer payments are dominated in volume by card-based transactions, but the format of these is starting to become “buried” under layers of “veneer” interfaces, many of which rely on card-on-file for their funding source.

To the consumer, these veneers look like “new ways to pay” and certainly deliver the more convenient and seamless experience that people seem to be seeking. But underneath, the funds are moving between the payer and payee accounts as they have always done.

The new rails provided by the NPP will not generate any new transactions in the market, but will take volume from existing systems. For the sake of efficiency and the economy, one hopes that the NPP will accelerate the decline in cash usage and lead to the termination of cheques. But it will also take volume from Direct Entry and card payments. Just as Swish has entered ecommerce and the point of sale market in Sweden, once the cost of NPP transactions reduces (as it should with volume growth) then one would expect it will also appear in the online and POS environments.

The increasing use of electronic payments in Australia should see the overall cost of payments as a percentage of GDP decline and the tax take through GST and income tax rise – both of which are beneficial for the country.

Disclaimer: The opinions expressed in this article are the author’s own and do not necessarily reflect the view of Indue. The Initiatives Group has advised participants in the payments market since the 1990’s – including issuers, acquirers, third-party processors, technology providers and associations. The Initiatives Group has a strong relationship with Indue, and can help participants in the payments sector generate more value from their markets and customers. To find out how, please get in touch.