Development of industry Confirmation of Payee Solution

Australian Payments Plus (AP+) has resolved to work with NPP Participants to deliver a Confirmation of Payee service for payments made using BSB and Account numbers. Confirmation of Payee will help reduce certain types of scams that involve misdirection of payment to an account that does not belong to the intended payee as well as avoid mistaken payments to incorrect account numbers.

Following a series of design workshops and in consultation with NPP Participants, AP+ have resolved on a technical design for delivering a Confirmation of Payee solution. The recommended solution involves using confirmed BSB and Account number data with either payee name display or account name matching being presented to the payer. This service would be delivered via NPP infrastructure, standardised APIs and a centralised account matching service managed by AP+. The solution will also seek to leverage additional payment and account data (derived from other financial institutions or potentially third parties about potential scam accounts) which could be incorporated into fraud mitigation strategies and risk assessment by participating financial institutions.

In consulting with NPP Participants on how best to bring a solution to market, there was considerable interest in seeing how a phased delivery approach that leverages observed data as an interim approach (in the absence of confirmed account data) could be taken together with the sequencing of centralised capability. This approach would give those organisations the option to deliver a solution to their payer customers according to their preferences and individual organisational readiness. The target-state solution will include use of confirmed data which could be optionally augmented by other data sources.

Commencing December 2023, AP+ will commence a detailed design phase of work with further design discussions being planned before the end of 2023, whilst in parallel engaging with its vendor to start work on developing capability, which is expected to be delivered, in phases, by the end of 2024.

During 2024, once the first phases of capability are likely to be delivered (including API connectivity leveraging existing NPP Payment Gateways), financial institutions could look to integrate to the service to support Confirmation of Payee for their account holders and provide Confirmation of Payee services within their banking channels. This includes leveraging observed data as an interim approach to deploy a Confirmation of Payee service by those financial institutions who would like to use observed data sources during 2024.

Later in 2024, additional capability will be made available to NPP Participants to support centralised matching of information entered by payers with account data held by payee banks and displaying these results to payers. Additional data could continue to be leveraged for broader insights that could be used for fraud mitigation and risk assessment purposes.

At conclusion of the detailed design phase of work, in early 2024, the AP+ expects to mandate as much capability build as it considers necessary to ensure that a comprehensive Confirmation of Payee solution is broadly available within a specific timeframe.

We expect that a phased delivery approach could see existing Confirmation of Payee capability that exists today extended further during 2024, with a broad solution expected to be in place from early 2025.

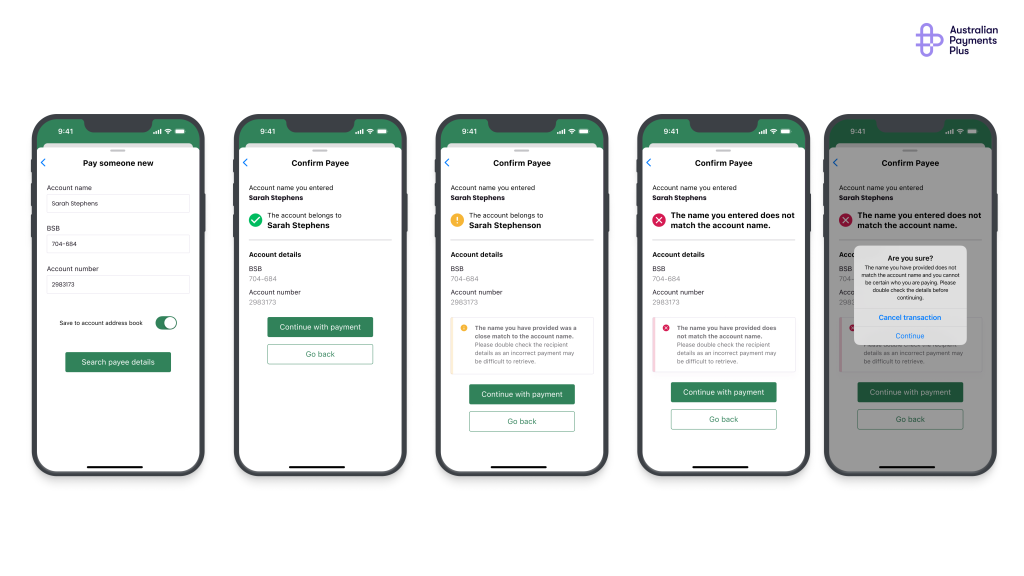

The ultimate Confirmation of Payee service is likely to include displaying the Payee account name to the prospective payer, only if the name is a match or close match to the name entered by the payer. If the name provided by the payer does not match the name held by the payee’s financial institution, then the payee’s name will not be displayed, as illustrated below.